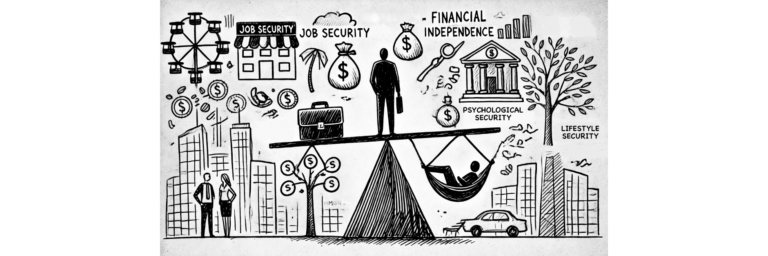

Why Relying on Job Security is a Fallacy and How to Build True Security

We’ve all been raised to believe that as long as we have a stable job, we’re safe. This mindset is especially true for seasoned professionals—after many years in the workforce, I have seen firsthand how job security has been considered a foundation of stability. But here’s the thing: job security is no longer what it…