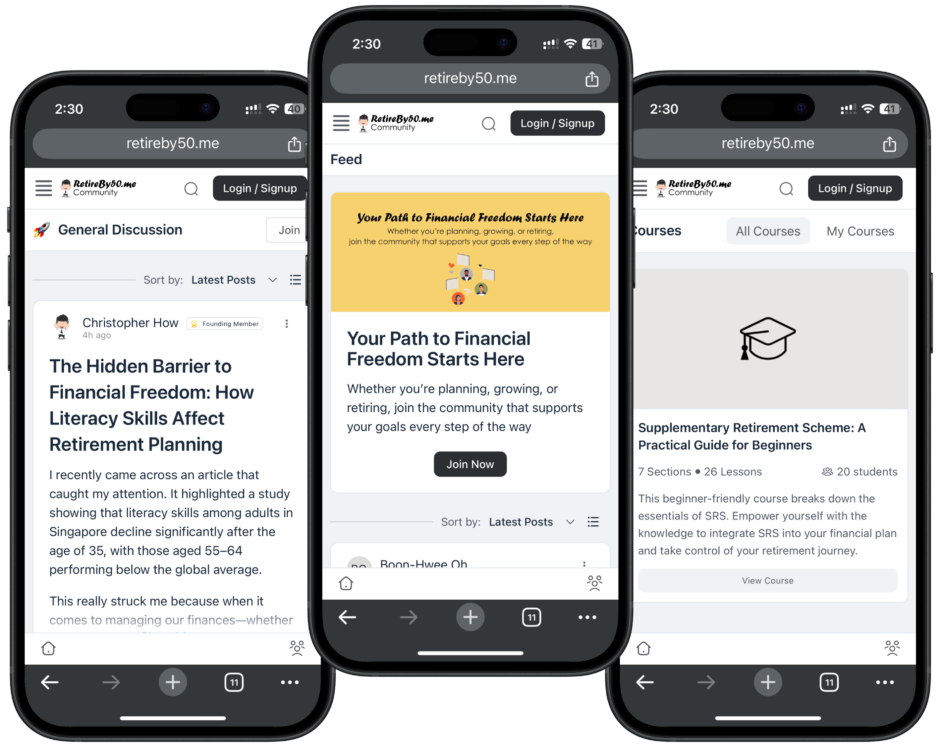

Why Join the RetireBy50 Community?

Retiring by 50 is more than a goal—it’s a lifestyle choice. Our community empowers you with:

Start your journey today and take the first step toward living life on your own terms.

What Others Say About Us

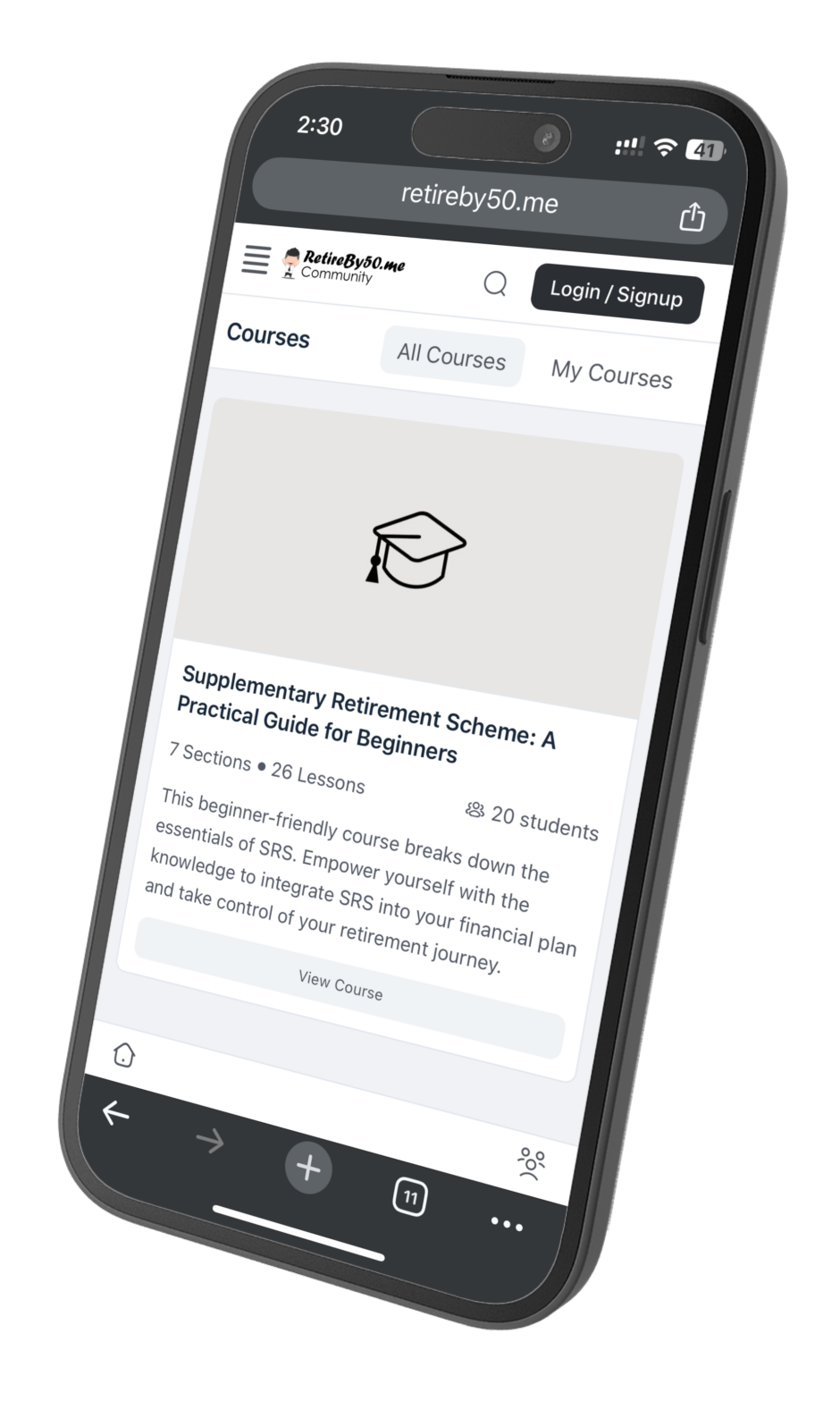

Learn and Grow with Our Courses

We’re excited to announce our latest course, Supplementary Retirement Scheme: A Practical Guide for Beginners.

This comprehensive guide will help you:

Join our community and gain instant access to this course and more resources to fast-track your financial independence.