What is the Wuhan Coronavirus and will it change your investment strategy?

The biggest topic trending on the streets for the past few days has been the Wuhan Coronavirus that has infected thousands and spread to multiple countries so far. I’m not going to post any statistics here because those numbers are meaningless and you should check official sources for real-time statistics.

One of the major challenges today is the fact that China isn’t the most transparent country so you can’t really be sure if the information shared on the Internet is true or not.

In fact, there was a false rumour going around Facebook claiming that Woodlands MRT was closed for disinfection due to a suspected case of the Wuhan Coronavirus infection, urging the public to avoid that train station. Ministry of Health has come out to clarify that this was false.

Instead of watching the latest video shared by your friends on Facebook or listening to the latest pantry chatter, I highly recommend everyone to visit the Ministry of Health website to get the latest update on the virus and what we can do to try and reduce the chances of getting infected.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

Here are some resources from credible sources

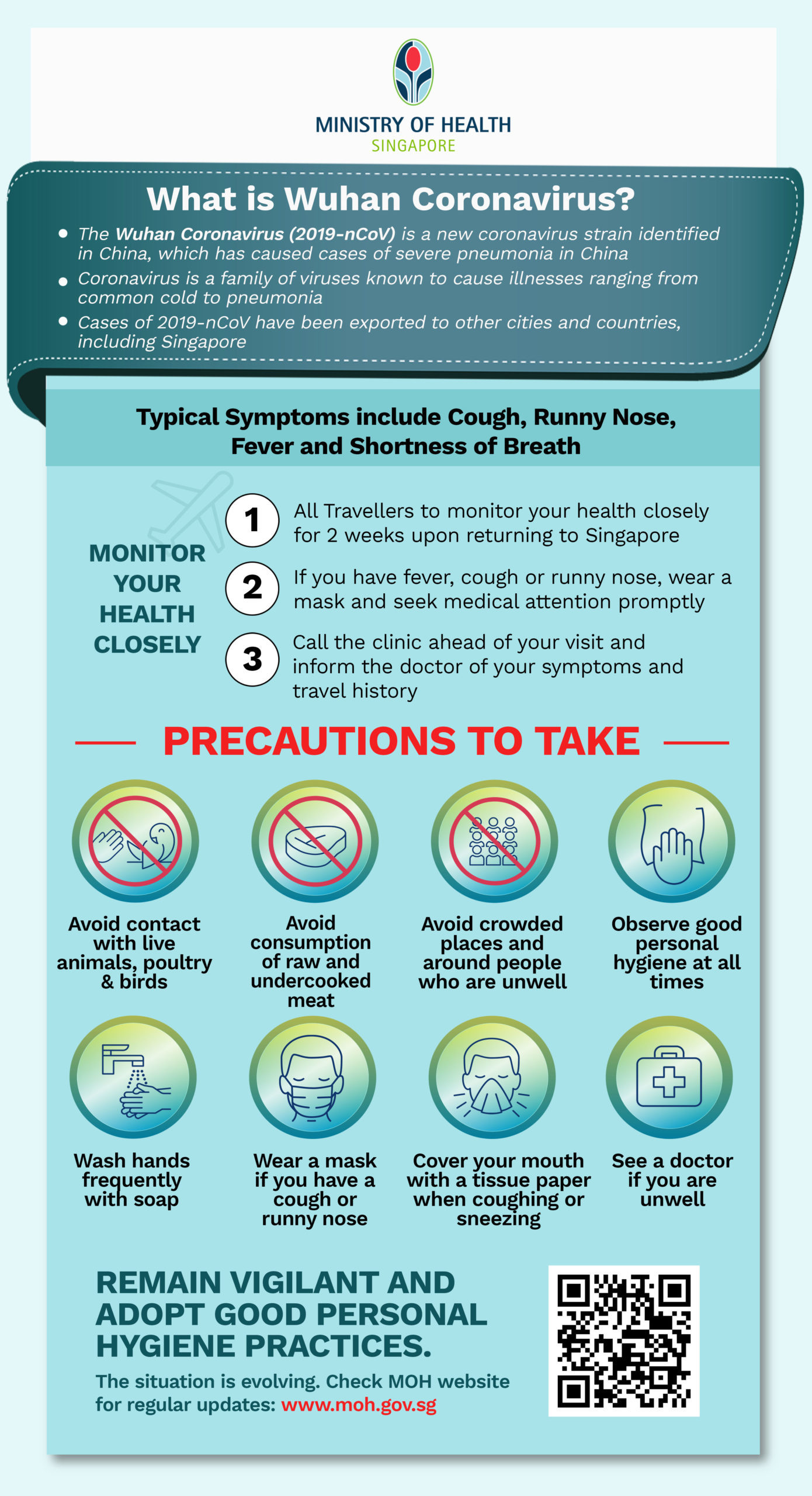

Here are a few resources released by the Singapore government and the Ministry of Health.

Infographic on what is Wuhan Coronavirus and what precautions you can take today

Prof Leo Yee Sin of National Centre for Infectious Diseases (NCID) answers a few key questions about the Wuhan Coronavirus

Will the Wuhan Coronavirus change how you invest?

For some people, they have the know-how and the capital to make bets on specific sectors and stocks to capitalise on trending news like the Wuhan Coronavirus.

Brian Halim from A Path to Forever Financial Freedom took a bet on Top Glove Corporation Bhd, a rubber glove manufacturer that owns and operates 43 manufacturing facilities in Malaysia, Thailand, and China. He purchase their shares at $1.72 per share using CFD leverage at 2.8%.

Top Glove Corporation Bhd closed at $2.35 today and I’m happy for Brian.

Are you making bets on companies based on the Wuhan Coronavirus?

Personally, I’ve not done anything remotely similar because I don’t have the know-how and capital to make similar bets. I also know that I’ve never been good with luck-based games like blackjack, toto, 4D so it’s unlikely that I’ll get luck with short term stock picks. I also know that I lack the mental strength in making such bets. The last time I shorted a stock many years ago, I wasn’t able to concentrate 100% at work and was consistently checking the stock price.

I’m much better at skill-based games like mahjong where I have some level of control over winning and losing, and it’s a longer game where the winners and losers are determined after multiple rounds.

I’m better off not making any stock bets for short term gains to take advantage of the current situation.

Keep some dry powder on hand in case the market goes down the toilet

We know that on a macro level, some of the industries are going to be affected if the Wuhan Coronavirus situation continues for a few more months (at least).

For example, we know that retail stores are going to be experiencing lesser footfall which translates to lower sales. If this continues for the long term impact, shopping malls may also be challenged with retaining their existing tenants.

Major businesses like Starbucks and Yum China (KFC and Pizza Hut) are starting to choose to suspend operations until further notice. The profitability of those businesses are clearly going to take a hit in the books.

We are also seeing stock prices of pharmaceutical companies going up but that’s mostly investor sentiments since it will be months before any company comes up with a vaccine for the Wuhan Coronavirus.

I’m going to stay invested with the bulk of my cash in my portfolio, my dry powder will mostly consist of my CPF Ordinary Account which will be progressively deployed if the market tanks by say, 20%?

Choosing to stay invested and not lose sight of the long game

As a lazy investor, it’s times like these when I have to keep reminding myself that my investment portfolio is for the long game (at least 10 years). I don’t intend to make any big changes to my investment portfolio and continue to make incremental investments every month.

Remembering that I’m going to stay invested for the next 10-20 years, the Wuhan Coronavirus is going to look like a small situation when I look back at this when I retire at 50.

If the prices of those ETFs that I’m investing in are heading on a downward trend, I’m happy to be getting them at a cheaper price. I know that this month’s incremental investment is going to average down the equities in my investment portfolio.

Staying healthy is also an investment

Don’t be overly-fixated in making investment decisions. Remember that your health matters as well!

Take the necessary precautions to reduce the risks of getting affected by the Wuhan Coronavirus, or any other illnesses.

Eat more healthy food, exercise regularly, and practice good personal hygiene.

Are you changing your investment strategies because of the Wuhan Coronavirus? I’d love to hear your thoughts in the comments below.

Photo by Piron Guillaume on Unsplash

Look at the charts of STI & Hang Seng during H1 2003 …. the drop due to SARS was less than 20%.

On a longer term time frame from 1990 to 2010, you can barely see the STI & HS chart movements during that SARS period.

Of course valuations by early 2003 were super cheap thanks to 2+ years of bear market (starting mainly from Q4 2000), but still… Singapore (and HK) stocks are still not particularly expensive currently (except certain REITs).