I am switching to Endowus for my SRS investments and here’s why

Since 2014, I’ve been topping up my Supplementary Retirement Scheme (SRS) account and investing through OCBC’s Blue Chip Investment Plan (BCIP), buying into Nikko AM Singapore STI ETF stocks each month in a dollar cost averaging manner.

For a lazy investor like me, this works really well because just like my cash investments through AutoWealth, all I have to do each month is to top up my SRS account and BCIP will make the purchase automatically at the end of the month.

At the same time, I avoid timing the market and getting swayed by market fluctuations.

Although I like how everything has been working out for the past 6 years, the Straits Times Index (STI) had a muted performance, considering we are undergoing the longest-running bull market in history.

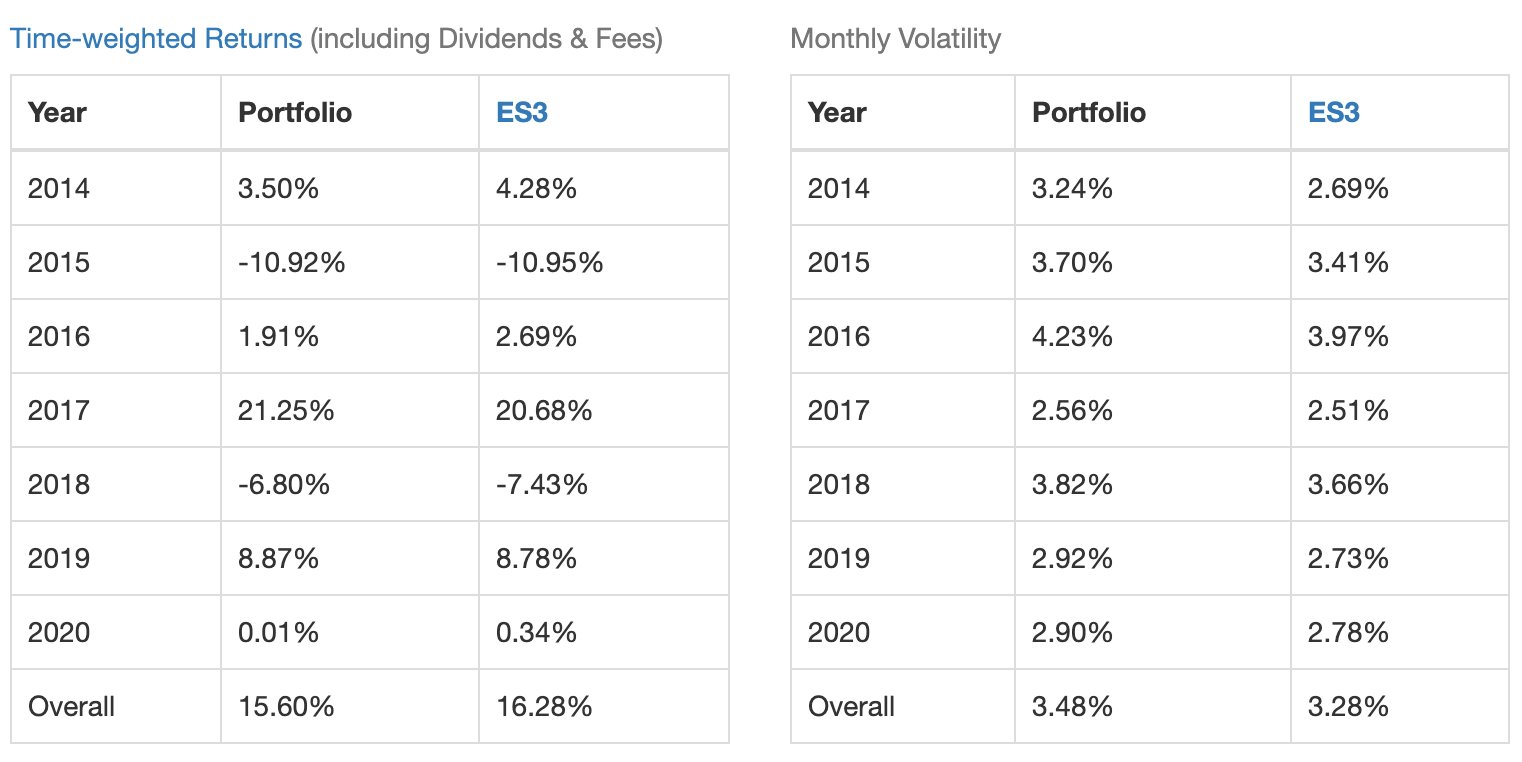

Now that i have set up my StocksCafe account (use my referral link to test all their features for 2 months for free!), I am able to show how my SRS portfolio has been performing for the past 6 years.

The dividend yields from Nikko AM Singapore STI ETF is growing but doesn’t get me excited given I’m going to be invested for the next 20 years and growth are much more important than dividends.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

Shifting my SRS investment from a Singapore-focused portfolio to a global diversified portfolio

Given the lackluster long term performance of the STI, I’m convinced that it will be a better move to convert my SRS portfolio from being 100% Singapore-focused, into a global diversified portfolio.

For the past few years, I’ve been struggling to find a simple and automated way to do this. In my exploration of potential platforms and funds, the costs of investing can add up pretty quickly to around 1% to 3% per year.

For layman investors like me, it’s can be challenging to sieve through all the funds offered on platforms like Fundsupermart and Dollardex, especially some of the feeder funds that are investing in multiple ETFs and funds (that means I’ll need to read up on all those ETFs and funds!).

But these days, things are changing with robo-advisors like Endowus starting to allow investors to invest their SRS funds in funds from Dimensional Fund Advisors (DFA) for less than 1% per year. In my case, I’m looking at DFA’s World Equity fund that charges 0.43% per year and Endowus charges an Access Fee of 0.4% per year.

Let’s talk about Dimensional Fund Advisors

Kyith from Investment Moats has written a comprehensive article about DFA in his blog and I don’t think I can do any better than him on this so you should read his article to get an in-depth knowledge about DFA.

But in a nutshell, here’s what you need to know.

Founded in 1981, DFA uses market financial data to design and manage portfolios. They take a less subjective and more systematic approach to investing. They believe that by implementing this approach consistently, investors will understand and stick with their approach, even in challenging market environments.

In the course of their research, DFA found that securities offering higher expected returns share certain characteristics, which DFA call dimensions. To be considered a dimension, these characteristics must be sensible, persistent over time, pervasive across markets, and cost-effective to capture.

With these dimensions, DFA created broadly diversified portfolios that emphasize the dimensions of higher expected returns, while addressing the tradeoffs that arise when executing portfolios.

What resonated with me is how DFA chose to use data as the foundation in their approach towards designing investment portfolios in a strategic and systematic manner.

As of 30 June 2019, Dimensional has $586 billion (USD) in firm-wide assets under management.

Investing my SRS funds through Endowus

Endowus is the first robo-advisory platform that can help you invest your CPF and SRS funds for a low fee. I’ve heard them speak in a few personal finance and investment events.

In this blog article, I’m going to be focusing on solely about investing with your SRS funds.

Here’s an excerpt about Endowus that I’ve taken from their website.

“Our investment strategy is underpinned by a scientific process rather than speculation. We utilize modern portfolio theory that uses time-tested investing rules such as diversification and asset allocation to maximize your returns while minimizing risk. For equities, we utilise passive and systematic portfolios that have broad market exposure with tilts towards proven factors of returns such as value, size, and profitability, as evidenced by the research of Nobel Laureate academics. For fixed income, we leverage the expertise of the largest fixed-income investors in the world and their ability to execute time-tested strategies with real track records.”

One of the most popular question that everyone has on their mind is how rebalancing will be executed.

“Over time, the value of individual investments in your portfolio will move up and down and drift away from your target asset allocation. If an underlying holding drifts by more than 10% from its target allocation (i.e. a fund with a target allocation of 10% moves by more than 1%), we will send you an email to inform you. You will have the option to opt out of rebalancing if you choose, however, we believe an optimized rebalancing that maintains the target asset allocation is a meaningful contributor to long-term returns. If you do not choose to opt out of rebalancing your portfolio back to its target asset allocation, we will go ahead to execute the rebalancing three business days after you receive the email. Every cash flow (deposit or withdrawal) is used to rebalance your portfolio towards the target weights. In the absence of cash flows, we rebalance by selling and buying existing funds in the portfolio.”

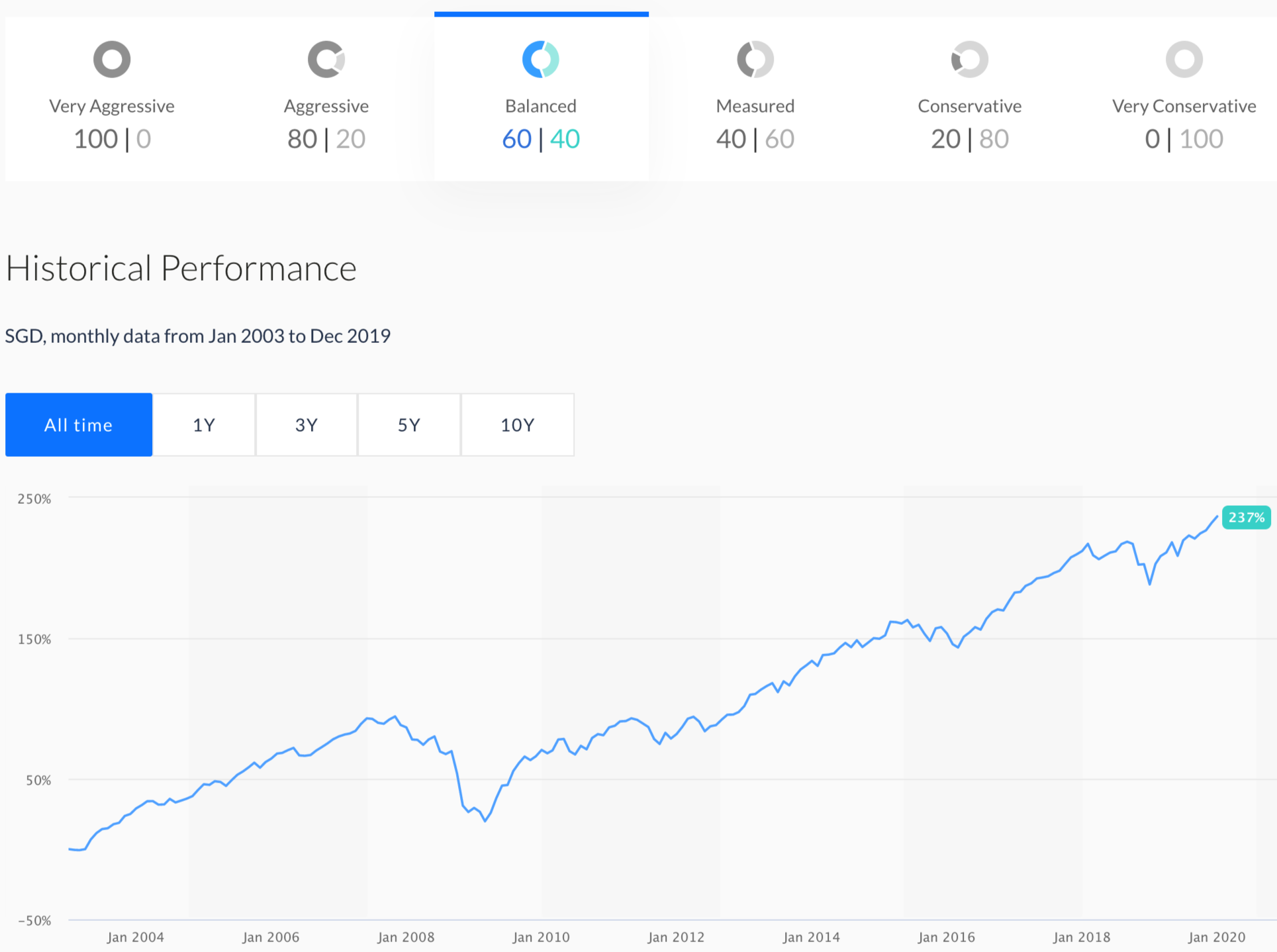

Where does your invested money in Endowus get invested in?

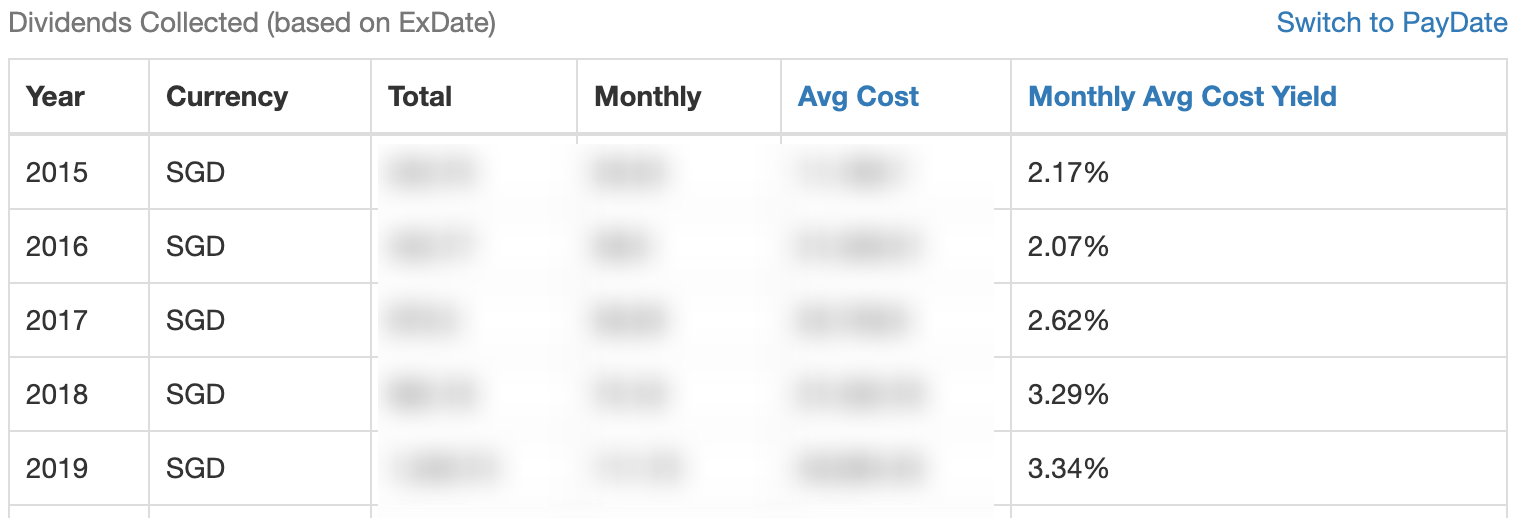

In the process of registering my account, I played around with their Model Asset Allocations to see what funds will they recommend me to purchase based on my preferred asset allocation.

Here’s what an 60/40 equities and bonds asset allocation recommendation looks like.

By toggling around the different asset allocation models, I was able to see that Endowus will invest my money in the following funds based on my selected asset allocation model:

- Dimensional World Equity Fund (Equity allocation)

- PIMCO GIS Global Bond Fund (Bond allocation)

- PIMCO GIS Emerging Markets Bond Fund (Bond allocation)

- PIMCO GIS Global Real Return Fund (Bond allocation)

Similar to AutoWealth, what I like about this is that there’s only 4 funds that I need to read up on and understand where the money is bring invested in. I just need to research on them and decide whether I like these funds, or not.

Before doing any research, decide on your asset allocation first. In my case, I only intend to do an investment with 100% equities allocation so I only need to do my research on Dimensional World Equity Fund.

My deep dive into Dimensional World Equity Fund

Dimensional World Equity follows a simple and repeatable approach that blankets nearly every investable company in the world, including emerging-markets companies.

Using the research of renowned academics such as Eugene Fama and Kenneth French, the strategy focuses on stocks with lower valuations (measured by price/book ratio), smaller market capitalisations, and higher profitability (using an adjusted measure of operating income).

Their research shows that stocks with these characteristics have tended to outperform over the long term. The managers exclude the most expensive and unprofitable companies completely and apply market-cap multipliers to give under or over weightings to the remaining stocks, depending on how much they possess of the desired characteristics (that’s the dimensions we talked about earlier).

The result is a portfolio that is broad and well-diversified, with a blend of growth and value stocks.

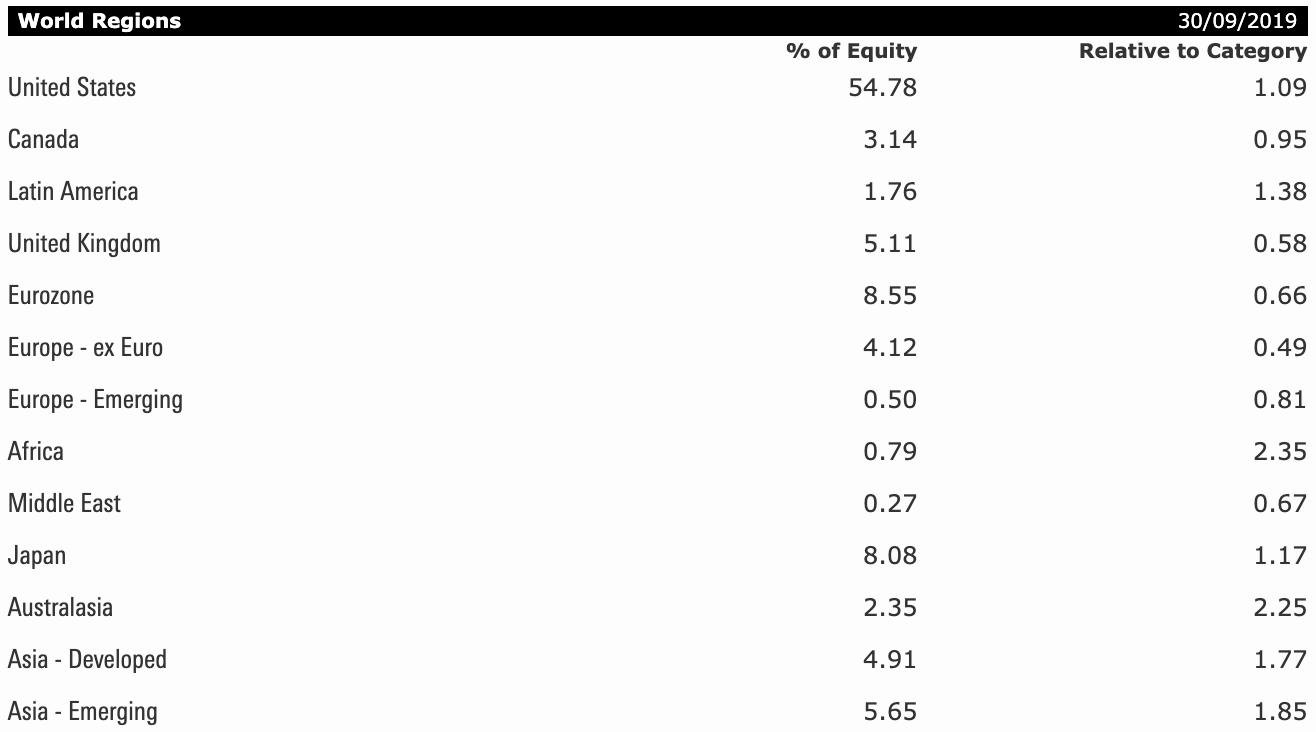

Looking at the fund’s investment across the globe, we can see that it remains heavily invested in United States with 54.78% of equity invested in that region.

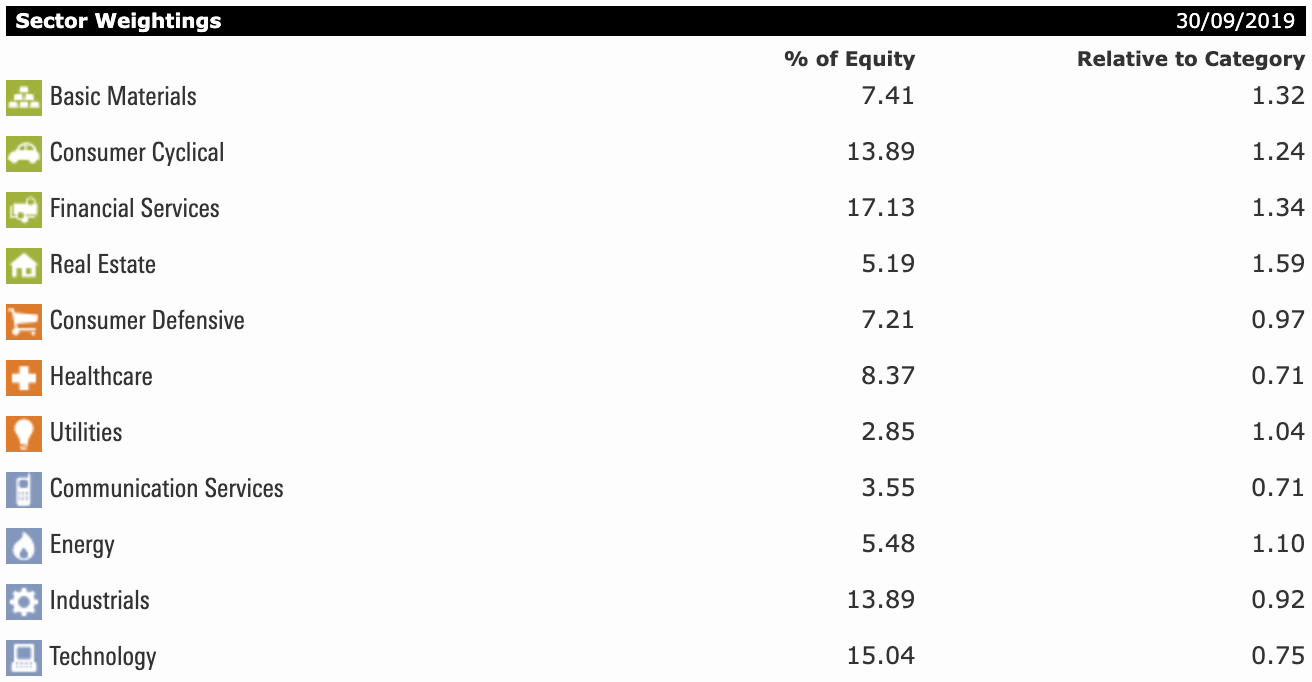

In terms of sector weightage, we can see that the fund is also well-diversified across Consumer, Financial Services, Industrials and Technology. This is important as I’m planning to invest for the long term and not be affected by cyclical market fluctuations.

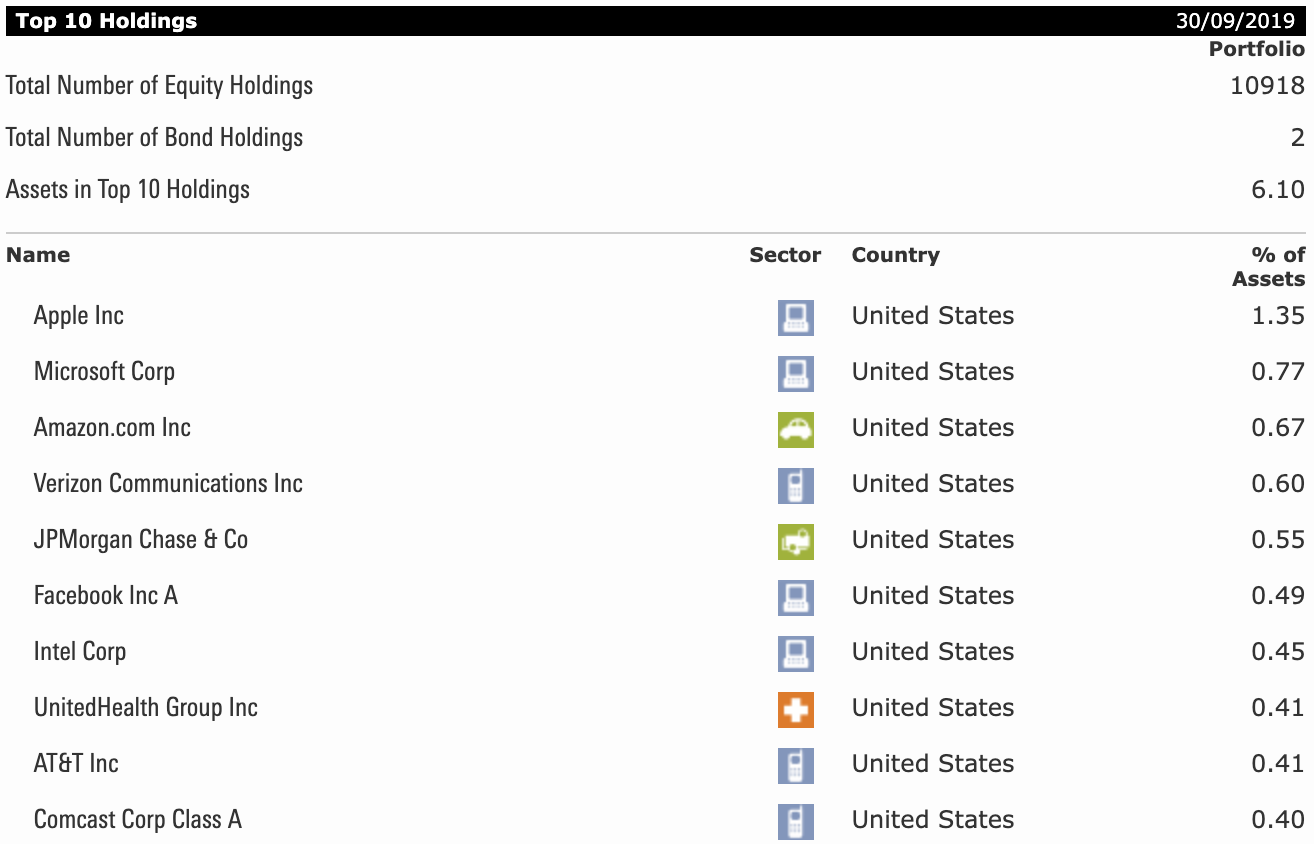

Even though the fund is heavy on United States, the top 10 stocks that is held by the fund is only 5.69% of the entire portfolio. That tells us that the fund is so diversified that not a single company will be able to cause the fund to incur a huge loss even if it closes down.

Dimensional World Equity Fund in a nutshell

- ISIN: IE00BF20L762

- Launched in 19 Mar 2018

- Fund type: Open Ended Investment Company

- Price currency: SGD

- Domicile: Ireland

- Benchmark: MSCI All Country World Index (ACWI)

- Fund Size (Mil) as of 27/01/2020: GBP 1757.88

- Dividends: Accumulating

- Expense Ratio: 0.43%

- Total number of stocks invested as of 30 Sep 2019: 10,918 stocks across the globe

My experience using Endowus to invest my SRS funds

Registering my Endowus account was an easy and seamless process that required very little interaction with the Endowus support staff.

I registered my Endowus account following the instructions on the website and it took 2 days for my UOB Kay Hian account (used by Endowus to make the investments on my behalf) with the linking to my SRS account to be ready for investing.

It took a total of 4 days for my SRS funds to move from my OCBC SRS account into my UOB Kay Hian account and invested into Dimensional World Equity Fund by Endowus.

A total of 6 days from account registration to being invested is relatively fast, compared to my past experience with other investment platforms. I also like that everything was communicated in a timely manner through email so i didn’t have to log into my Endowus account daily to check on the progress.

I have also scheduled recurring investment using my Endowus account so that money will be moved from my SRS account into Endowus every month and injected into my investment portfolio for dollar cost averaging investing.

Having enjoyed a great experience investing through Endowus, I’ve been recommending my friends to invest their SRS funds through the Endowus platform.

Have you invested your SRS funds through Endowus? I’d love to hear your experience on using their platform.

Start your investment with Endowus

This is not a sponsored post, but I do have an Endowus referral link that you can use to register your Endowus account. We will each get $20 in Access Fee credit (equivalent to $10,000 advised free, assuming Access Fee of 0.40%) after you have created and funded your account.

it’s not a lot of money, but it can pay for 6 months of Access Fee.

– for endowus i would go for max 80/20. If im paying 0.4% access fee, i want it to be for managing a portfolio, not 1 fund. I think 80/20 still gives very good returns.

– as usual my issue with dfa is their fund has been underperforming a market cap fund for years (value vs growth). Who knows how long more it will underperform

– hope you do a comparison with Stashaway and soon-to-be-available-for-srs Syfe

for SRS only. why did you choose endowus? there are other platforms avail. maybe you would like to do an article on it?

Interesting thoughts, for my SRS, I’m using Stashaway, have you tried it before?

Hi, I’ve checked out Stashaway before and their investment portfolio is too complicated for me. I’m also not comfortable with the fact that they can change the portfolio allocation at their terms because of this black box called, “Economic Regime-based Asset Allocation”. But that’s my point of view and some people specifically invested with Stashaway for this black box. 🙂

Hi, great explanation and I just signed up for Endowus SRS too.

Just curious why you would not use Endowus for your cash investments too and still stick with Autowealth? I believe there wouldn’t be estate tax as well as lower withholding tax.

Hi Ben,

I started my AutoWealth portfolio a few years ago and it’s already automated. The reason why I did not switch it over to Endowus is because the total fees (management + fund expense fees) charged by Endowus for a 80/20 portfolio is much higher than AutoWealth’s 80/20 portfolio due to the underlying funds selected. The ETFs selected by AutoWealth is easy to understand while Endowus’ recommended portfolio has more funds selected and that means spending more time to research and understand the funds.

As both portfolios from AutoWealth and Endowus are more focused on capital gains, the dividends received are relatively low compared to dividend stocks. Therefore, I felt that the withholding tax savings does not matter too much.

Regarding the estate tax, I do agree that it may be something worth considering when my portfolio with AutoWealth is a significant percentage of my overall net worth, like 50-80%. Today, it’s still a small percentage in the grand scheme of things and my dependents probably benefit more from my insurance payouts than my existing investment portfolio and the insurance payouts would be more than enough to cover the estate taxes.

But in future as I get much closer to my retirement stage, I think I’ll definitely be looking at making major changes to ensure my dependents will have to pay as little estate tax when I die.