Why Relying on Job Security is a Fallacy and How to Build True Security

We’ve all been raised to believe that as long as we have a stable job, we’re safe. This mindset is especially true for seasoned professionals—after many years in the workforce, I have seen firsthand how job security has been considered a foundation of stability. But here’s the thing: job security is no longer what it once was. We’ve seen how even the most profitable companies, like Samsung and Dyson, make tough decisions that leave employees out in the cold.

If you already have a strong savings rate and a desire to retire early, the idea of job security being tied to a company is not only outdated, it’s risky. You’re focused on financial independence and escaping the corporate rat race, but relying on your job for stability isn’t the way to get there.

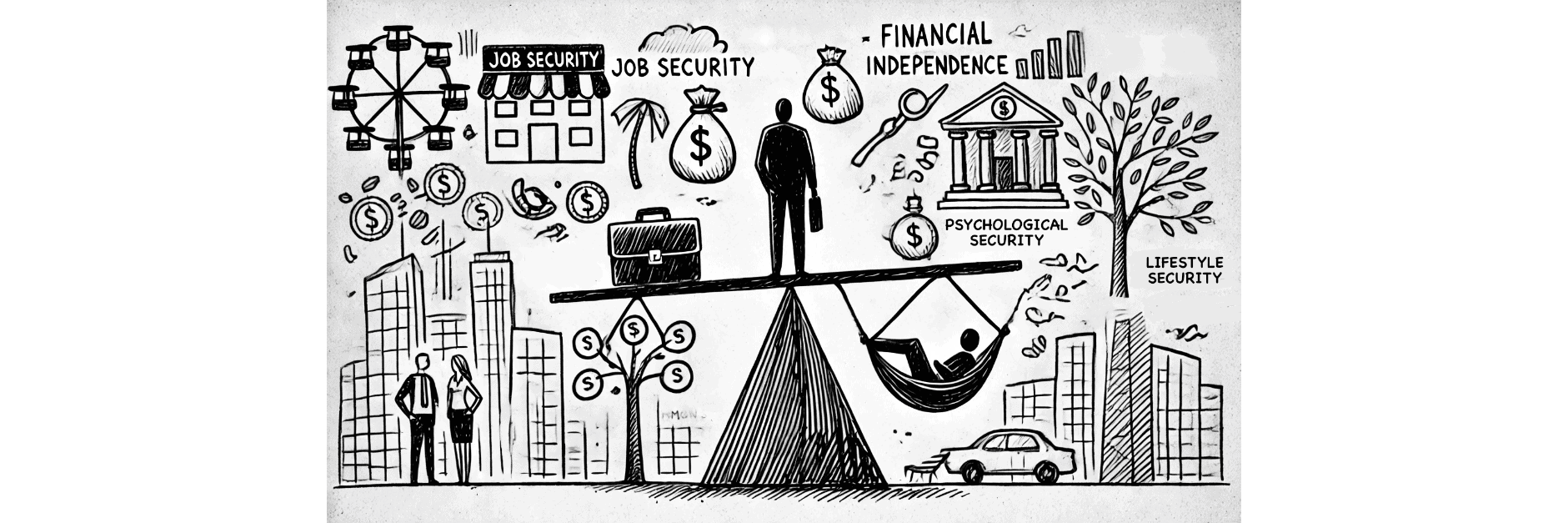

So let’s talk about how to build real security—the kind you control, independent of your employer or job title—so you can retire early, maintain your lifestyle, and take care of the people you love.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

Why Job Security Is a Fallacy for Professionals Like You

With your experience and position, it’s easy to assume that your job is secure. After all, you’ve been working for many years, have led teams or played a crucial role as an individual contributor, and have done well for yourself. But even in stable roles, the reality is that job security isn’t in your control. Businesses will make decisions based on profits and efficiency, not loyalty.

Even in Singapore, where unions exist, many retrenched workers have found themselves disappointed. They realise too late that these unions often act as paper tigers—providing little more than symbolic protection. You’ve worked hard to save and secure your financial future, but relying on a company or union for your future security isn’t a viable plan.

For someone in your position—who’s already saving aggressively—the real risk is not job loss itself, but how to ensure you’re building the right financial strategy to support early retirement, avoid outliving your savings, and navigate future uncertainties like inflation and healthcare costs.

What Security Do You Really Need?

You’ve probably already started thinking beyond job security and toward financial independence. But it’s more than just saving—security comes from knowing you’ve got a plan that works, even when things go sideways. Here’s how to build the kind of security that allows you to retire early, maintain your lifestyle, and cover those future uncertainties.

1. Financial Security Beyond the Job

You’re already saving a significant portion of your income—somewhere between 50% and 70% annually—which puts you ahead of most people. The next step is making sure those savings work for you.

Invest, without the headache

You’ve been a disciplined saver, but you’re not interested in becoming a full-time investor. That’s completely understandable. There are strategies—like automated investing and robo-advisors—that can help you invest without needing to constantly learn the details of the market. This way, your money grows while you focus on what matters most.

Build an emergency fund

With your income and savings rate, a strong emergency fund is a must. This will give you the cushion you need in case job instability does hit, so you’re not forced to dip into your long-term savings before you’re ready.

2. Skill-Based Security by Leveraging Your Strengths

You’ve already proven your value with the years you have clocked in the workforce. But as you approach your goal of early retirement, the key is adaptability and leveraging your skills.

Keep your skills sharp, but don’t overcommit

You don’t need to learn an entirely new field or overextend yourself trying to chase the next career trend. Focus on refining your current skills and staying updated in your field. This keeps you valuable in the market without needing a complete overhaul.

3. Lifestyle Security to Enjoy Retirement Without Compromise

Your goal is to retire early without sacrificing the lifestyle you’ve worked so hard to build. You want to maintain your standard of living while also accounting for inflation and healthcare costs down the line.

Coast FI to keep things simple

You may not need to keep grinding away for another 10 or 20 years. By using strategies like Coast FI, you could save enough that your current investments grow over time while reducing the need for constant contributions. This way, you can retire early and confidently, knowing your lifestyle is secure.

Plan for healthcare and inflation

Inflation and healthcare are two of your biggest worries, and rightly so. By factoring these into your retirement plan now, through long-term investments or insurance coverage, you can safeguard your future and maintain peace of mind.

4. Psychological Security to Create Purpose Beyond Work

With retirement on your horizon, your identity and sense of purpose will eventually shift away from work. While you’re still focused on your career now, it’s important to start thinking about what will bring you fulfillment beyond your professional life.

Find fulfilment outside of work

Whether it’s hobbies, side projects, or contributing to your community, finding something that gives you purpose outside of work will make the transition to retirement easier.

Prepare emotionally for the shift

Early retirement sounds great, but it also requires emotional readiness. The shift from being a full-time working professional to having more time on your hands can feel jarring if you’re not mentally prepared for it.

5. Take Control of Your Own Financial Security

Your past experiences with financial advisors haven’t been great, and I understand why you’re wary. You want personalized, genuine advice—not someone just selling you products. The good news is, you can still take control without having to micromanage every aspect of your finances.

Automate your investments

Using a financial advisor or automated investment platform that aligns with your goals can help you grow your wealth without the constant need for involvement. Look for someone who listens to your concerns, understands your need for trust, and offers a personalized plan to suit your lifestyle.

Protect against retrenchment before it happens

You’re already aware of job instability in today’s world. But instead of focusing on the worry, focus on preparation. Your strong savings habits, emergency fund, and investment strategy should serve as your protection. Be proactive about these decisions rather than waiting for the worst to happen.

True Security Is In Your Hands

The idea of job security is fading fast, but for most of us, that doesn’t have to be a bad thing. You’ve already taken the first steps toward financial independence with your aggressive savings and desire for early retirement. By taking the next step—focusing on investing strategically, preparing for the future, and creating purpose beyond work—you can build the kind of security that isn’t reliant on anyone but yourself.

You’ve worked hard to reach this point. Now, it’s about making sure your plan is solid, your investments are working for you, and your lifestyle is secure, even in retirement.