The most important lesson from Mr CPF, Loo Cheng Chuan (that nobody talked about)

I’ve heard Mr CPF, Loo Cheng Chuan speak on multiple occasions so far. In his recent talk at an event organised by Endowus, he mentioned a very important lesson about financial independence that was rarely highlighted in articles about him.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

Who is Loo Cheng Chuan?

In case you have not heard of Loo Cheng Chuan, here’s a quick recap.

Loo Cheng Chuan is your typical Singaporean. Married with 3 children, he created a financial safety net for himself by topping up his CPF Special and Medisave Accounts at an early age, and just let it compound over a long period of time to over half a million dollars. Combined with his wife, they have over 1 million dollars in their CPF accounts since reaching 45 years old, and on the way to a multi-million CPF accounts when they retire at 65 years old. He founded a movement called, 1M65 to encourage Singaporeans to inspire Singaporeans that they can get very rich with CPF.

To date, Loo has shared his story at 71 speaking engagements and he has not received a single cent in payment for his talks. He has also been interviewed by several media and blogs about his feat.

What was your dream job as a child?

Don’t we all have dreams and ambitions when we were young?

Maybe you wanted to be a professional soccer player, a crime-solving police officer, or even a world famous musician.

But for most of us, we did not chase after our dreams because they get chiseled away, a little at a time as we grow up, by reality.

Many of us ended up in jobs we may not be passionate about, but they pay the bills.

Having a strong financial safety net allows you to chase your dreams

Here’s something I felt that wasn’t given enough emphasis in articles about Loo.

The fact that having a strong financial safety net, knowing that you have a million dollars waiting for you at the age of 65 without the need to do anything more, means you are now free to chase your dreams.

Having read through tons of articles and books about retirement planning, I felt this was an important point that deserved more focus.

Loo chased after his business passions

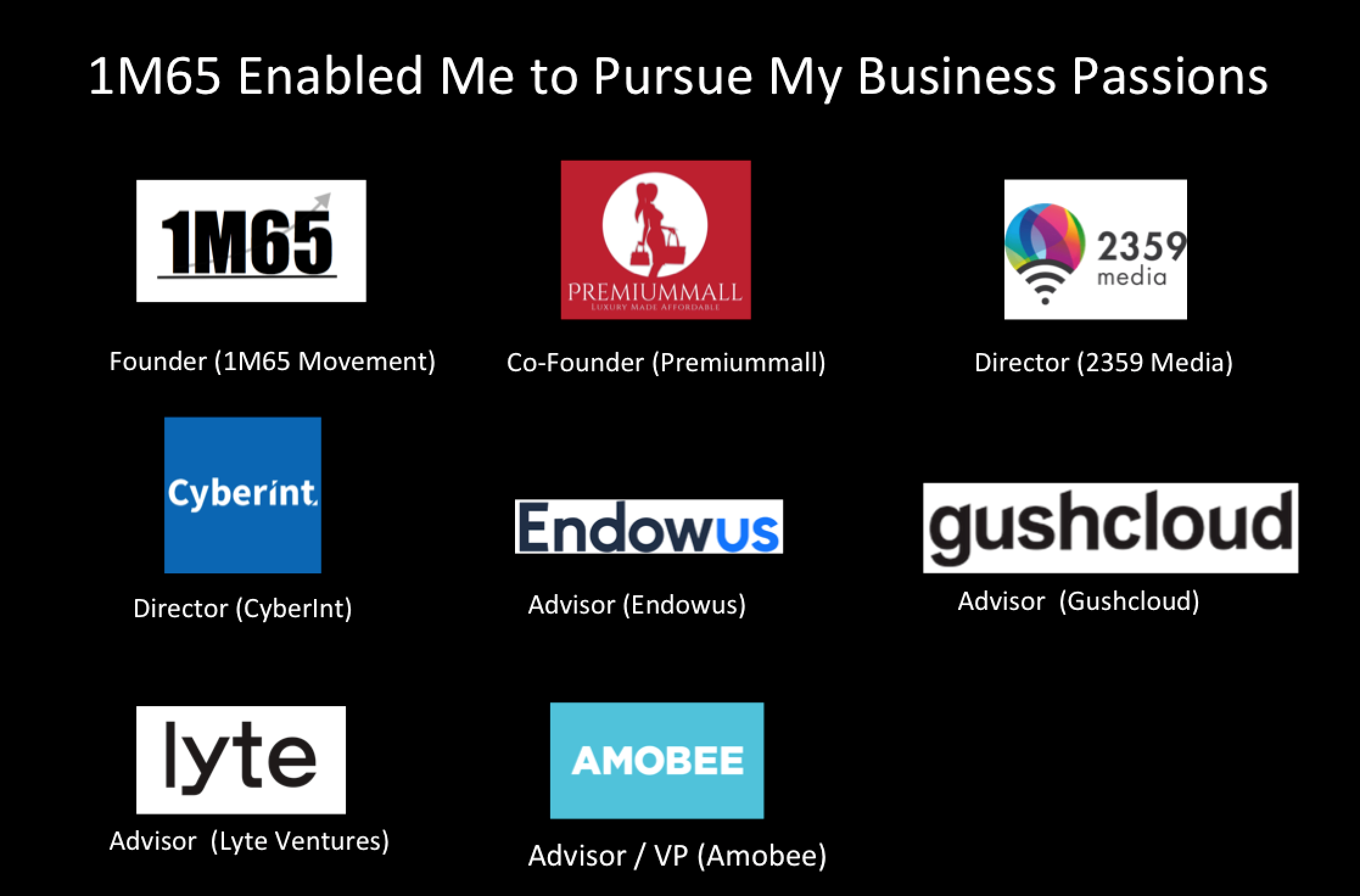

With a strong financial safety net in place, Loo pursued his business passions.

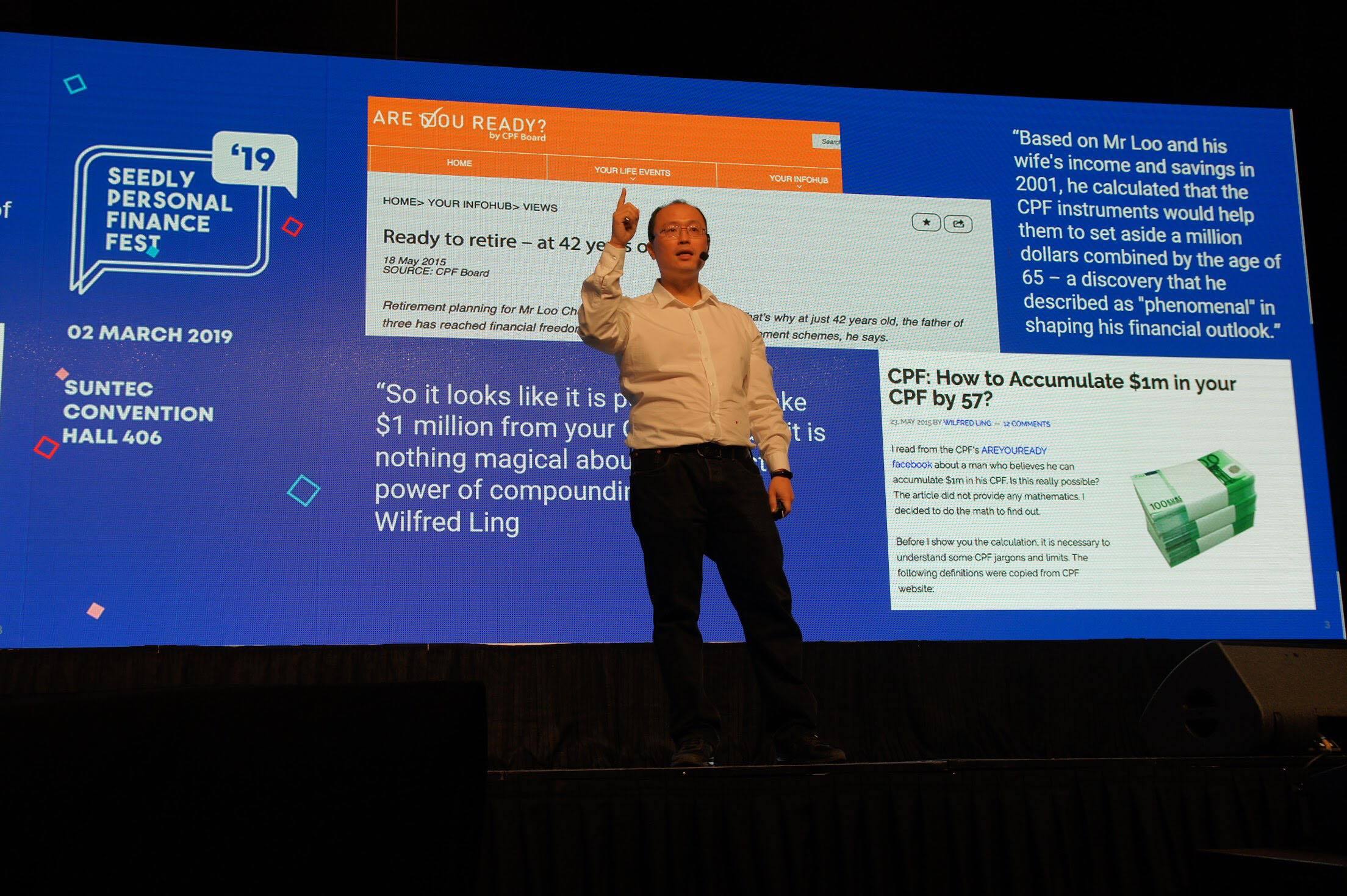

When I heard Loo speak at the Seedly Personal Finance Festival 2019, he talked about founding the 1M65 movement and starting an online business with his wife to sell leather bags.

Fast forward to almost a year later, he and his wife passionately founded a Luxury Fashion Business. Furthermore, he has invested in several startups and holds director or management-advisory positions in several companies.

According to him, his strong CPF safety net has made his multi-business endeavours much easier. If he did not have this financial safety net in place, I imagine he would still be working in a 9 to 5 job, like most of us.

What are you doing to build your financial safety net?

While I like my CPF Special Account for its stability and guaranteed 4% interest rate (until the government announces any policy changes), it’s not my only retirement planning tool.

My financial safety net consists of my CPF accounts, investments made through my Supplementary Retirement Scheme account, cash investment portfolio in AutoWealth and my rental property in Cambodia.

What’s your financial safety net like? Please share them in the comments below.

LCC did not talk about his current enterprise for obvious reason; he does want his audience to think he is on stage to promote his biz, which would surely assuage his noble intention of his message. Many speakers under the guise of noble education have motives of enriching themselves.

CPF is important.

But its adequacy as a safety net should not be overstated. Indeed, as a safety net, it is awful for one reason, i.e., liquidity. If your business (or passion) fails at age 45, and you need immediate liquidity to service your mortgage/loans and put food on the table, your $1M in CPF SA/MA/RA is going to provide nothing but cold comfort.

Focus on building up a passive, liquid income stream before you concern yourself with the CPF.

No doubt, famous financial bloggers like ASSI talk a lot about topping up the CPF. But one should note that people like AK already derive a healthy passive income from dividends. To them, CPF is merely a diversification tool into a risk-free, low to moderate yield product, not a “safety net”.

Actually the most important thing that no one, including Loo Cheng Chuan, talks about is looking after your active earning ability. Everyone assumes that everybody naturally will be able to have a median salary (or above) job for the long haul that brings in streams of cash decade after decade. This may be somewhat true-ish in your first 30 years of life, but not necessarily true after your 40th or 45th year.

The other 2nd most important thing regarding CPF is paying for property — if you only buy BTO and never upgrade, chances are you’ll be able to achieve at least FRS by 55 *without* even needing to top up a single cent into CPF.

Of course if you’re a high income earner or upper middle income, by all means upgrade & whack all your CPF-OA for property if you want, since your wealth & retirement will be more outside of CPF. CPF should be inconsequential to your net wealth.

Well said. Rich or high income earners need not rely on CPF as safety net. As an employee, one needs to work hard to ensure one remains employed, strive to get promoted for increased income and hopefully work until retirement. CPF will take care of itself. Most should have at least FRS by age 55 if one does not divert it for investment etc.

Great article