How a Singaporean accumulated CPF Full Retirement Sum in his Special Account by the age of 34

Update: A reader was curious how much Daniel had in is CPF Special Account in 2015 before he started topping up his CPF account. Daniel had $64,374 in his Special Account when he started.

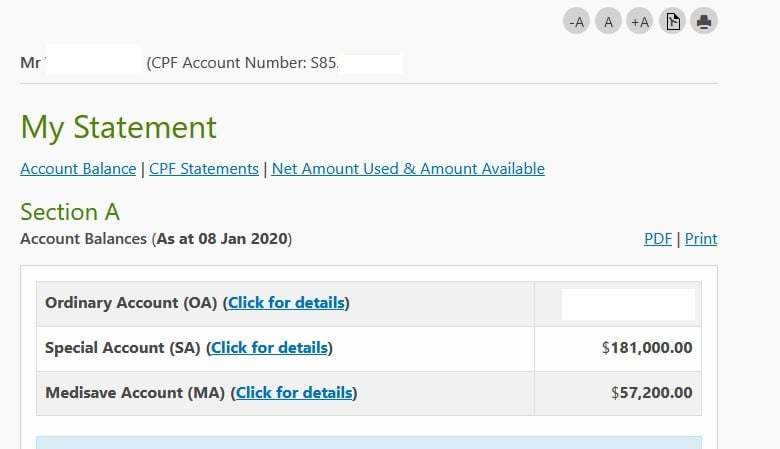

Last Wednesday, Daniel, a 34-year-old Singaporean wrote a post in Seedly’s Facebook group to share how he managed to achieve the current CPF Full Retirement Sum of $181,000 this year with screenshots of his CPF account balances as proof.

Screenshot of Daniel’s CPF Statement

Shocking? Let’s break down the details to understand how Daniel did it.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

How it all started

When Daniel was 29, he read the Secrets of the Millionaire Mind by T. Harv Eker and a series of blog posts on A Singaporean Stocks Investor (ASSI) about CPF.

He was motivated to set a series of financial goals for himself to improve his financial situation. One of his mid term goals was to achieve the CPF Full Retirement Sum with his CPF Special Account by the age of 40. He has only one job and doesn’t have any side hustles.

Here’s how Daniel did it

Like all Singaporeans, regardless of our financial status, we have 3 methods to increase the balance of our CPF Special Accounts.

- By working to get 6% (age 35 and below) of our total monthly wages into Special Account.

- By transferring money from Ordinary Account to Special Account (before age 55) to tap on the 4% interest rate that Special Accounts earn.

- By making cash top-ups to Special Account (before age 55) through the Retirement Sum Topping-Up Scheme (RSTU) to make a direct impact to the account balance.

In Daniel’s case, he made use of all 3 methods to grow his CPF Special Account and that required 6 years of disciplined saving and meticulous planning, laser-focused on the single goal of achieving Full Retirement Sum.

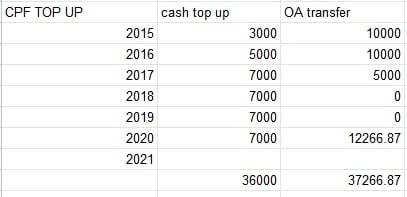

On top of full-time employment, Daniel did a combination of cash top up and OA transfer to achieve Full Retirement Sum in his CPF Special Account

Referring to the table above, Daniel started with a $3,000 cash top-up through RSTU and $10,000 transfer from his Ordinary Account to his Special Account in 2015. I imagine the $3,000 was spare cash that he had at that time.

We should also note that Daniel owns a HDB property with his wife and they use the money in their Ordinary Account to pay for the monthly mortgage. The $10,000 that Daniel transferred from his Ordinary Account to Special Account must have been carefully calculated to ensure he has enough cash buffer in his Ordinary Account to service his mortgage loan after the transfer.

From 2016 and 2017, Daniel became more intentional in growing his Special Account as he set aside cash specifically for cash top-ups through RSTU and transferred more money from his Ordinary Account to his Special Account.

In 2018, he pivoted in his plans to not make any transfer from his Ordinary Account to his Special Account in order to be able to make a few more years of cash top-ups through RSTU (both 2018 and 2019) and be entitled to the $7,000 tax relief. This makes a lot of sense, especially when you intend to work for at least a few more years.

By 2020, Daniel was done. He did a cash top-up of $7,000 and transferred $12,266.87 from his Ordinary Account to his Special Account. This was because he calculated that he would have achieved Full Retirement Sum without doing the transfer. But by doing so, he would be able to have more money in his Special Account and accumulate more interest next 20 years before he reaches the age of 55.

That’s a smart and intentional planning in getting as much Full Retirement Sum money in Special Account as possible.

Here’s what we don’t know about Daniel

What I’ve written above is based on what we know from Daniel’s post. It may not be the entire story that allowed Daniel reach Full Retirement Sum by 34.

What if Daniel is CEO of a multi-national company, earning loads of money above the average Singaporean? PS: By the way, I know for a fact that Daniel isn’t.

The Ordinary Wage Ceiling for CPF contribution is currently capped at $6,000. No matter how much total monthly wages you earn, only 37% of $6,000 gets into your CPF accounts if your age is 55 and below.

The Additional Wage Ceiling is a CPF contribution cap on your additional wages, such as your bonuses. The formula for calculating the Additional Wage Ceiling is $102,000 – Ordinary Wages subject to CPF for the year.

$102,000 – ($6,000 x 12) = $30,000

As of now, when your monthly salary is $6,000 or more, up to $30,000 of your additional wages will have mandatory CPF contributions.

Personally, I don’t believe being a super high earner would have made a drastic difference that the average Singaporean can’t achieve with a few more years.

What we can learn from this?

I believe that CPF LIFE will be one of my core retirement income stream when I retire. If you have the same mindset as me, it definitely makes sense to start accumulating more money in your CPF Special Account beyond the usual salary contribution.

By doing so, you can achieve the Full Retirement Sum earlier when the figures are much smaller, and let the 4% interest pay for future incremental Full Retirement Sum adjustments.

Strive to rise up the corporate ladder as early as possible to earn a $6,000 monthly salary as early as possible to maximise your CPF contribution.

Make voluntary contribution* to your MediSave Account to hit the Basic Healthcare Sum so that work contributions to your CPF MediSave Account along with end of the year interest will overflow into your CPF Special Account for those below 55 or to your Retirement Account if you are 55 and above.

* VC to MA for a calendar year is subject to CPF Annual Limit of $37,740 or member’s cohort BHS, whichever is lower. Any excess VC would be refunded without interest.

Create good saving habits so that you have surplus money to be able to make the decision to top up your CPF Special Account through RSTU when it becomes beneficial for you to do so.

What changes are you making to get to Full Retirement Sum earlier? I’d love to hear your thoughts in the comments section below.

Photo by Clark Tibbs on Unsplash

Assuming his salary increases each year he will lose out in terms of tax savings in later years because he cannot claim tax relief on cpf top ups. Its not wise to contribute at such early part of career.

I agree with your perspective. I feel that it really boils down to individual preferences and what matters more.

In my case, I’m looking to stop climbing the corporate ladder at 50. So do I lose out a lot by contributing early? Maybe not.

But for someone who’s going to keep climbing the corporate ladder till a much later age, maybe he/she would lose out more because his/her salary will be exponentially higher in future.

He can do tax savings through SRS. With 15.3k per year he saves more than the 7k RSTU.

Top up to spouse or parent. This is a popular thing right now but forgo liquidity and flexibility. 4% yield on a class-a bond is lucrative I guess

No every body having good pay &cpf contribution like y

You may want to let readers know that if CPF retirement sum has been reached ,the interests earned cannot be withdrawn AFTER turning 55yr.

Hi Joey, do you have the link from CPF that mentioned this?

Hi joey , actually once u have accumulated the FRS by 55 . the cpf board allows you to withdraw all your money back ( SA first , then OA) . i have already personally went to cpf board and clarified, all your top up cash and interest is used form that part of FRS , so the rest from your work contributions can be withdrawn at 55

Assuming his current state (Max SA, Max MA):

Based on a max 6k CPF liable monthly income, Daniel will only able to increase his SA figure up to only about ~5k annually base solely on salary contribution. Any known method to help him increase his SA way more than that?

I can’t think of any ways off the top of my head right now, other than voluntary contribution which goes into all 3 CPF accounts.

Your post doesn’t mention how much money this individual had in his SA in 2015 before all the top ups took place.

Can you please add this detail?

Updated after checking in with Daniel. Hope that was useful.