This CPF Investment Only Made $182 in 10 Years. Here’s What Went Wrong.

Someone recently posted in the Seedly Facebook group:

“Hi! I’ve lost touch on my CPF investment scheme for more than 10 years. Invested when young and totally forgot about it. Happened to come across this statement today and would like to seek kind assistance and advise to ‘translate’ what this statement means? What should I do in this scenario? Thank you!”

If that sounds like you, don’t worry, you’re not alone. Many Singaporeans invested through the CPF Investment Scheme (CPFIS) in our younger working years, only to forget about those investments later on.

So, let’s unpack what this statement means, what it might have cost you, and what you can learn from the experience.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

What We Know from the CPF and ILP Statements

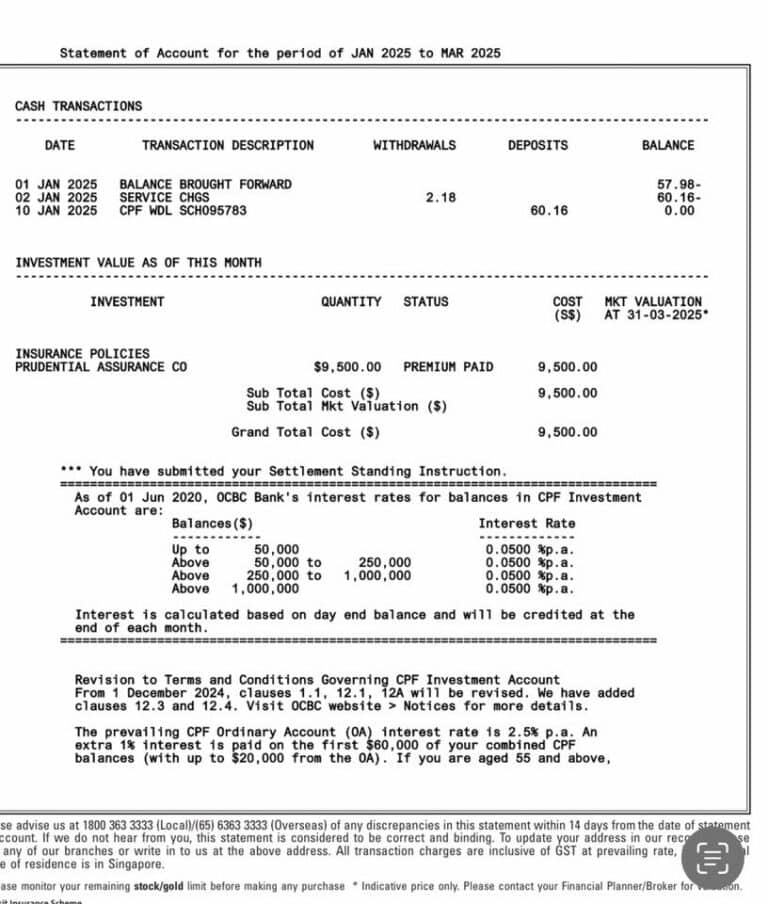

Here’s what we know from the statement and policy documents:

- $9,500 was invested through CPFIS into a Prudential Investment-Linked Policy.

- CPF’s statement only shows the original investment amount, not gains or losses.

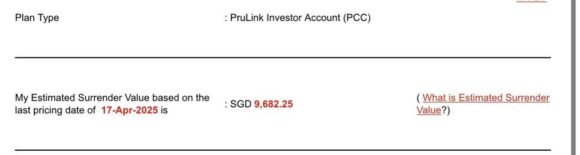

- The insurance company’s statement shows the surrender value today is $9,682.25.

So, on paper, it looks like a small gain of $182.25 after more than 10 years.

But what we don’t know, is what the $9,682.25 is being invested into.

But Did You Actually Gain?

Let’s do the math.

Over 10 years, that $182.25 return works out to an annualised return of around 0.19% per year.

But if you had done nothing and left the $9,500 in your CPF Ordinary Account, it would’ve earned 2.5% per year, risk-free.

Here’s how the two scenarios compare:

| Scenario | Capital | Value After 10 Years |

|---|---|---|

| CPFIS Investment (ILP) | $9,500 | $9,682.25 |

| CPF OA (2.5% interest) | $9,500 | ~$12,160 |

That’s a difference of more than $2,400 you could have earned just by not investing.

What Is the PruLink Investor Account (PCC)?

The PruLink Investor Account (PCC) is a CPFIS-approved Investment-Linked Policy (ILP) offered by Prudential Singapore.

ILPs combine an investment component with some insurance benefits. Here’s how they work:

- Your premiums are used to buy units in selected funds/sub-funds.

- The policy’s value fluctuates based on the performance of these funds.

- There are ongoing fees, fund-level charges, and potentially surrender charges.

According to Prudential’s website, this product falls under their wealth accumulation ILPs, with a focus on investment rather than protection.

If you want to find out exactly how your plan is structured, it’s best to contact Prudential directly or review your policy documents.

What Should a Good Financial Advisor Have Done?

Here’s something worth reflecting on.

You couldn’t have made this investment on your own. CPFIS-linked insurance products must be purchased through a financial advisor or insurance agent.

Which means… at some point, someone walked you through the process, filled out the forms, and recommended this product to you.

But what happened after that?

- Was there a review one or two years in?

- Did they check in when markets moved?

- Was there a conversation about switching funds or exiting if performance lagged?

- Did they help you reassess if this was still the best use of your CPF OA money?

I don’t have the answer as this was not shared in the post. So I wanted to put it here for the original poster (OP) to think about.

But don’t get me wrong.

These are just honest questions and not to assign blame, but to reflect on.

Because the truth is, many people were sold investment products but never heard from their advisor again. Not because the advisor didn’t care, but because the system was never built to reward long-term advice.

Why the Follow-Up Might Not Have Happened

In most cases, financial advisors are only paid lucrative commissions in the first 5–6 years after selling an ILP. After that, they stop getting paid, even though you’re still expected to hold on to the policy for more than 10 years.

And when someone is no longer being compensated, it’s hard to expect regular reviews, updates, or guidance, especially when they’re managing a large client base.

I mean, you wouldn’t want to work for free too, right?

It’s not always about bad intentions. Often, it’s just a broken model.

Which brings us to the real takeaway in this post.

The Importance of Understanding How Your Advisor is Paid

If you want someone to walk alongside you for the long term, to help you evaluate, adjust, and stay on track, then it makes sense to work with a financial advisor who:

- Is upfront about their remuneration model

- Charges an annual fee or ongoing advisory fee

- Has the right incentives that stay aligned with your goals

This doesn’t mean all commission-based advisors are bad, or that all fee-based advisors are better. But it does mean you should understand how your advisor is compensated, because that often shapes the kind of relationship you’ll have.

A Good Advisor Stays with You, Not Just Sells to You

This is what Vanguard’s Advisor Alpha concept highlights that the value of an advisor is not just in product recommendations, but in helping you:

- Stay on course when emotions get in the way

- Reassess when life changes

- Avoid underperforming products that quietly erode your returns

In this situation, a good advisor might’ve helped you switch to a better-performing fund, move the money back to CPF OA, or reallocate your CPFIS to something more suitable. A 15-minute review each year could’ve saved you more than $2,000.

That’s the real loss, not just in dollars, but in momentum.

What Should You Do If You’re in This Situation?

If you’ve found yourself in a similar spot, here’s what you can do:

1. Check the Current Policy

- Log in to your insurer’s portal or contact them directly.

- Find out the latest value, the underlying funds, and any charges or penalties.

2. Ask if the Product Still Serves You

- Does it beat 2.5% a year?

- Is there a better way to use your CPF money today?

- Would you make the same decision now if you were starting from scratch?

3. Re-evaluate the Kind of Advice You Need

If you value ongoing guidance, portfolio reviews, and having someone keep you accountable, it may be worth working with a financial advisor who’s compensated for providing ongoing service, not just selling a product.

Final Thoughts (and a Friendly Caveat)

This isn’t about regret because none of us have the power to turn back time. But we can decide what we want to do today.

Many people fall into the trap of “set and forget” investing, especially when CPF money feels out of sight and out of mind. But even small decisions, like where you park your CPF funds, can compound into big differences over time.

The good news? You can always take back control. And the best time to review your strategy is not when you have to, but when you still can.

If you’d like to learn how others are navigating CPF, retirement planning, and long-term investing, join the conversation at RetireBy50.me/community. We’re here to help each other make more informed, independent choices.

Disclaimer: This blog post is intended for general information and educational purposes only. It does not constitute personalised financial advice. Please do your own due diligence or consult a licensed financial adviser before making any decisions related to your CPFIS investments or insurance policies. Contact me if you want a fresh pair of eyes to review your policies.