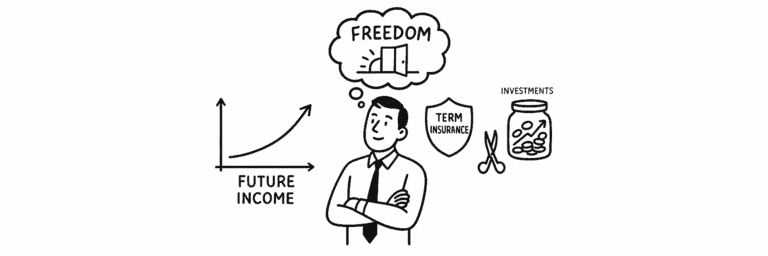

Your Career Is Your Biggest Asset (And That’s Why You Need Financial Freedom)

Most of us work to pay the bills. Some of us even manage to save and invest a portion of what we earn. But few people stop to think about this: Your career is your biggest financial asset. If you’re in your 30s or 40s earning $8,000 a month, that’s almost $2 million in future…