Achieving Financial Happiness: Insights from ‘The Geometry of Wealth’

In my earlier article, I wrote about how I view “bullshit” jobs and provided a view about whether it is worth working for the next 9 years just to save $354,471.39. As I continue my journey in exploring and experimenting to define what I want to do with my life, I’ve allocated a few hours of my mornings on reading to learn more from authors and experts.

I recently finished reading a book called “The Geometry of Wealth”. I first learnt about this book from a video in the YouTube channel called MoneyXYZ that talks about personal development and financial independence. In that video, the YouTuber talks about how he took 10 years to find his life purpose, despite having achieved a certain level of independence in both wealth and time.

Originally, I was uncertain why I haven’t arrived at a conclusion on what I want in life despite being 5 months into my career break. But when I think about how the YouTuber only managed to find his life purpose after 10 years, 5 months doesn’t feel like that long a time.

“The Geometry of Wealth” by Brian Portnoy is fundamentally about finding and aligning one’s financial decisions with the purpose of life. Here are my personal takeaways from this book.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

The Idea of Funded Contentment

Portnoy’s central thesis is that true wealth is “funded contentment,” meaning financial stability that supports a fulfilling and meaningful life. His perspective shifts the focus from merely accumulating wealth to understanding and achieving personal contentment and purpose. I don’t think of it as a radically new term. In a way, I would equate “funded contentment” as financial independence, but with the additional condition that one is able to achieve contentment and purpose in life. That said, this additional condition of achieving contentment and purpose in life, is one of the hardest things that the FI folks are trying to crack.

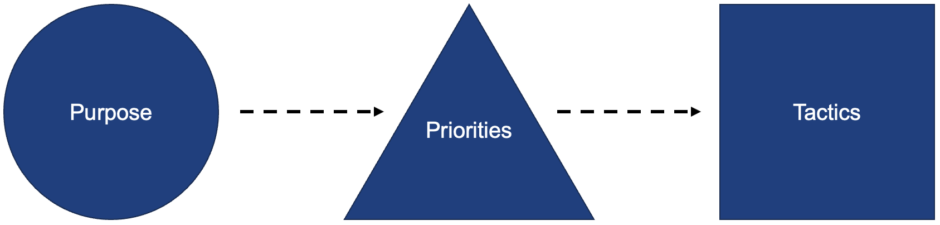

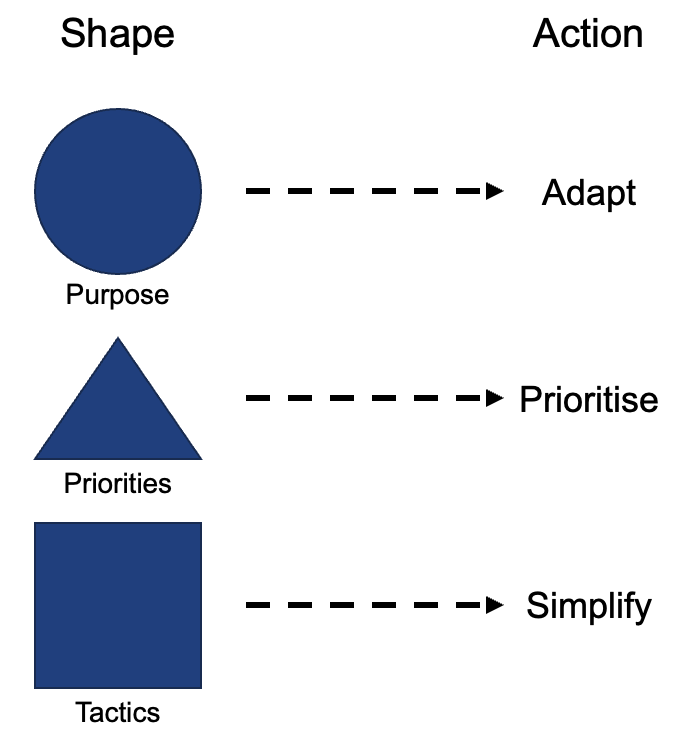

A Framework of Shapes

Brian Portnoy’s “The Geometry of Wealth” offers a structured and visually intuitive framework for achieving financial well-being through three primary shapes: circle, triangle, and square. Each shape corresponds to a different aspect of financial planning and aligns with actions that guide individuals toward achieving “funded contentment.” Here’s a detailed look at each component and its significance.

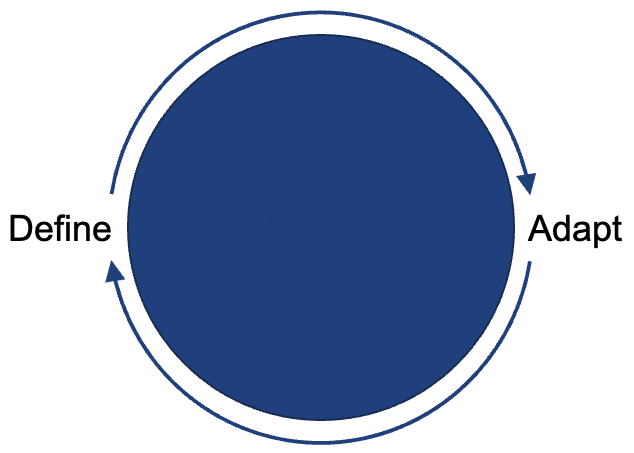

The Circle: Defining and Adapting Purpose

The circle represents the continuous process of defining and adapting one’s life purpose. Portnoy emphasises that understanding what truly matters to you is foundational to any financial planning.

This phase involves regular self-reflection and adaptation as your circumstances and priorities evolve over time. The circle signifies an ongoing journey, where the purpose is re-evaluated and refined to stay aligned with your personal values and life goals.

Action: Adapt – Recognise that purpose is not static and needs to be revisited and adjusted as life changes.

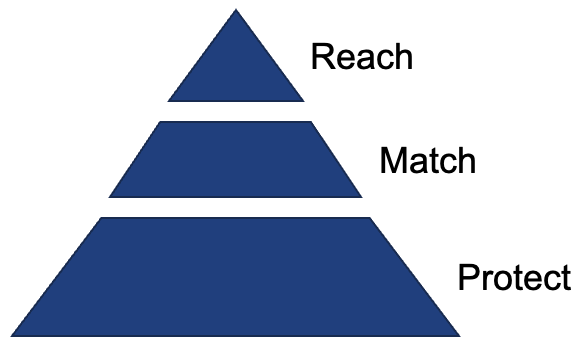

The Triangle: Setting Priorities

The triangle in Portnoy’s framework is about prioritising actions and decisions that align with your defined purpose. It is broken down into three levels: Protect, Match, and Reach.

- Protect: Focus on managing risk first. This step acknowledges that the pain of losses is greater than the pleasure of gains due to loss aversion. Effective risk management is crucial for long-term financial stability.

- Match: Align resources with goals. Portnoy distinguishes between terminal goals (fixed amounts, like paying off a mortgage) and flow goals (ongoing needs, like retirement). Adapting goals as circumstances change is vital.

- Reach: Strive for more by being aspirational. After securing protection and matching resources, the focus shifts to achieving greater financial aspirations and personal fulfilment.

This framework helps individuals set clear financial priorities that align with their broader life goals and purpose .

Action: Prioritise – Identify and focus on what is most important to achieve your financial goals.

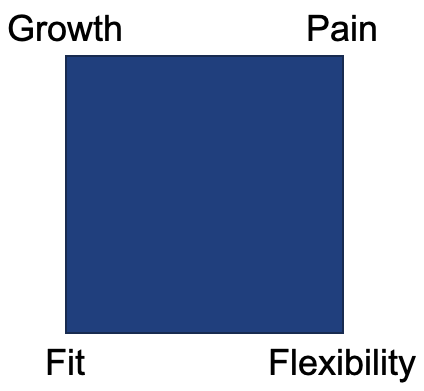

The Square: Simplifying Tactics

The square symbolizes the practical strategies and tactics required to implement your financial goals. It emphasises four key elements:

- Growth: Implement strategies that enable financial growth, such as investing in appreciating assets.

- Pain: Understand and manage the risks and challenges associated with financial decisions.

- Fit: Tailor financial strategies to your personal circumstances and goals.

- Flexibility: Maintain adaptable strategies that can respond to changing circumstances.

The square encourages simplifying complex financial decisions into manageable and actionable steps, ensuring that every action is aligned with your overall purpose and priorities.

Action: Simplify – Break down financial tactics into clear, simple steps that are easy to implement and monitor.

Adaptive Simplicity in Motion

Adaptive Simplicity in Motion is a core concept in the book that emphasises the importance of continuously refining and simplifying one’s approach to financial well-being when using the framework. This involves three main actions, each associated with one of the primary shapes.

Circle (Adapt): Regularly define and adapt your life purpose. Purpose evolves, requiring ongoing reflection and adjustment.

Triangle (Prioritise): Set and prioritise actions that align with your purpose. This helps in effectively managing resources and focusing on what truly matters.

Square (Simplify): Break down complex financial strategies into simple, actionable steps. This ensures that financial decisions are manageable and aligned with overall goals.

The idea is to create a dynamic, flexible approach to financial planning that evolves with changing life circumstances while maintaining clarity and focus on essential goals. This framework encourages continuous improvement and simplification, making financial decisions easier and more aligned with one’s life purpose.

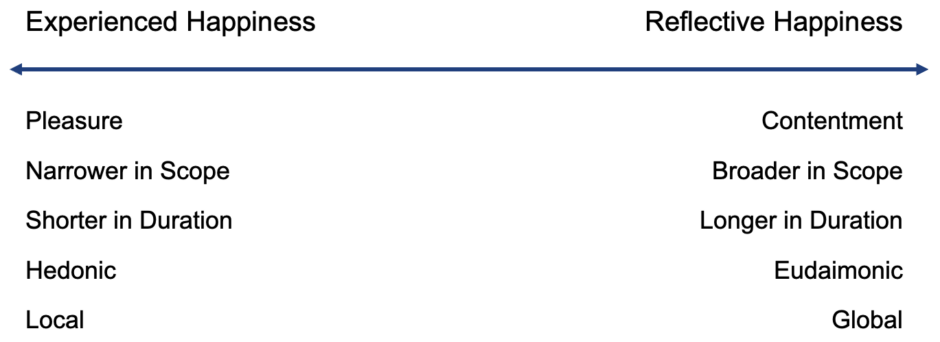

Experienced Happiness Versus Reflective Happiness

In the book, Portnoy has broken down happiness into 2 distinctive types and understanding both types of happiness is crucial for aligning financial decisions with personal well-being.

Experienced Happiness

This is the immediate, in-the-moment feeling of pleasure or joy that one encounters during specific activities or events. It’s the type of happiness measured through real-time assessments of one’s mood or emotional state. Examples include feeling joy while eating a favorite meal, laughing with friends, or enjoying a hobby. Experienced happiness is easy to achieve but that happiness only lasts for a fleeting moment. Imagine buying a luxury handbag that you liked for the longest time. The happiness gained from retail therapy disappears almost as fast as the time it takes to swipe your credit card.

Reflective Happiness

Reflective happiness involves a more cognitive, evaluative process where individuals think about their overall life satisfaction and well-being. It’s about looking back on one’s life and assessing whether it has been fulfilling and meaningful. This type of happiness is often influenced by achieving long-term goals, personal growth, and having a sense of purpose. It is also the type of happiness that is hardest to achieve and remains elusive to me after my 5-month search. But I believe it’s worth spending time searching for.

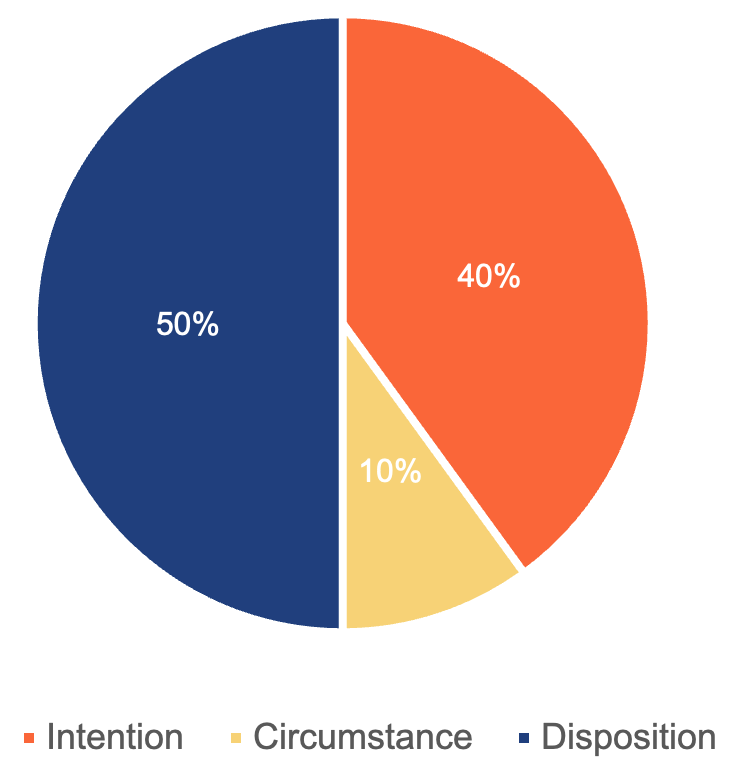

We Have Control of Our Lives, or at Least 40% of It

Some of my friends complain about the lack of control of their lives. In his book, Portnoy explains that while 40% of our happiness is within our control while the remaining 60% is influenced by disposition and circumstance.

| Disposition | Disposition is who you are. It includes innate personality traits and genetic factors that influence your baseline mood and behavior. Impact: Disposition accounts for approximately 50% of overall happiness. This includes inherent traits like optimism and resilience, which are largely beyond our control. |

| Circumstance | Circumstance refers to what you face. This includes external factors such as socioeconomic status, life events, and environment. Impact: Circumstance contributes around 10% to overall happiness. These factors are often beyond our control but have a relatively minor impact on long-term well-being. |

| Intention | Intention is what you do. It involves the conscious choices and actions you take to shape your life. Impact: Intention is the area where we have the most control, accounting for about 40% of our overall happiness. By making deliberate decisions and setting meaningful goals, individuals can significantly influence their life satisfaction. |

Focus on What You Can Control

Understanding the influence of intention, circumstance, and disposition helps in effective financial planning.

- Focus on What You Can Control: By aligning financial goals with personal values and purpose, individuals can use the 40% within their control to enhance long-term happiness.

- Adapt to Circumstances: While external factors are less controllable, recognizing their impact can help individuals manage expectations and make more informed decisions.

- Leverage Disposition: Acknowledging innate tendencies allows individuals to create financial strategies that complement their natural behaviors, promoting a more fulfilling financial journey.

By focusing on intention and understanding the roles of disposition and circumstance, individuals can craft a comprehensive approach to managing their finances that aligns with their broader life goals and enhances overall well-being.

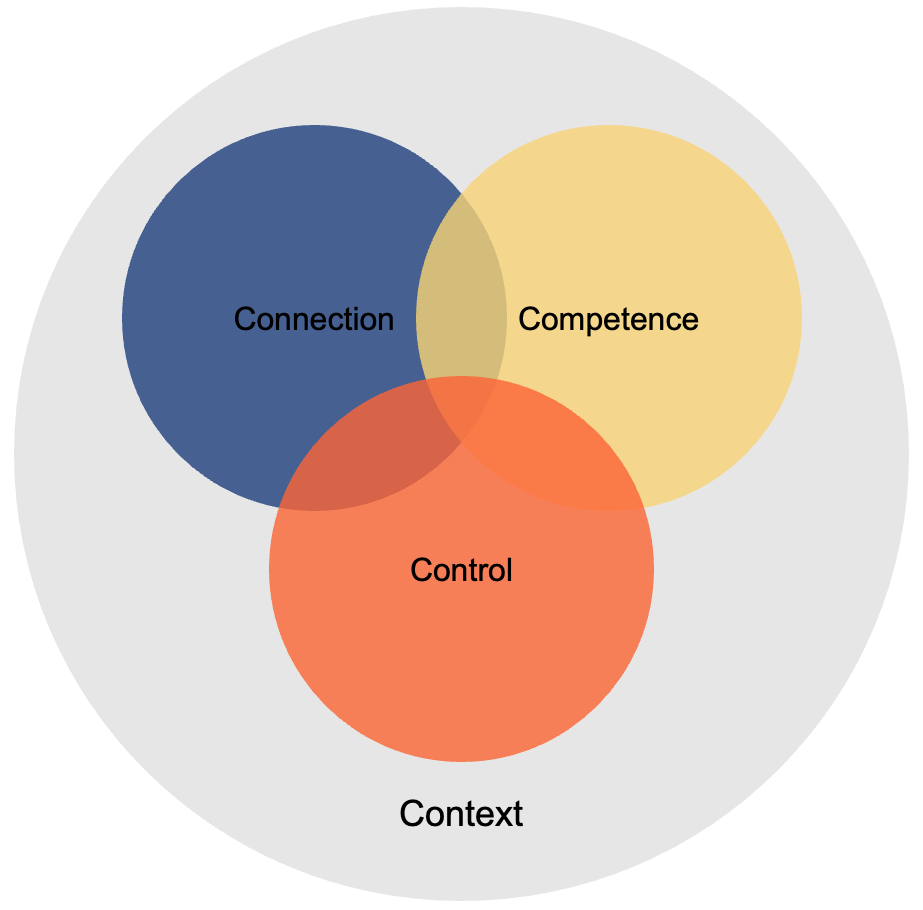

What Are the Ingredients for a Joyful Life?

What do you think is key to having a joyful life? In the book, Portnoy writes about four sources of a joyful life–connection, competence, control, and context. By addressing these four elements, he argues that individuals can create a more balanced and fulfilling approach to both life and financial planning, ensuring that their pursuit of wealth aligns with broader life satisfaction.

| Source | Definition | Impact |

| Connection | Connection refers to the quality of our social relationships. Humans are inherently social creatures, and strong, positive relationships are crucial for happiness. | Social connections provide deep meaning and significantly contribute to life satisfaction. |

| Competence | Competence involves being skilled and effective in what you do. It relates to the sense of achievement and capability in one’s professional and personal life. | Excelling in areas that matter to you is a profound source of fulfillment. |

| Control | Control is about having autonomy over your life and decisions. It means being able to influence your own destiny and make choices that align with your values. | Having control over one’s life reduces stress and increases happiness by providing a sense of agency and empowerment. |

| Context | Context is the larger sense of purpose that surrounds our actions and decisions. It’s about serving something bigger than oneself and finding meaning beyond personal gains. | A strong sense of context helps integrate the other elements (connection, competence, and control) into a cohesive, meaningful life narrative. |

Here’s how all the sources look like from a visual perspective.

Conclusion

Brian Portnoy’s “The Geometry of Wealth” offers a profound perspective on financial well-being by redefining wealth as “funded contentment.” It has made me think a lot more about what’s beyond financial independence. The book provides a structured framework using geometric shapes to represent different stages of financial planning—circles for adapting purpose, triangles for setting priorities, and squares for simplifying tactics. By integrating concepts from psychology, neuroscience, and economics, Portnoy emphasizes the importance of aligning financial decisions with personal values and life goals. Ultimately, the book guides readers towards a more meaningful, fulfilling, and well-balanced approach to wealth and happiness.

I must say that the book contains more writings about this topic but these are the takeaways that I was able to relate to. I believe that every one will have different takeaways and epiphany when they read the same book because we are all reading and analysing the information from our own lens and perspectives. Therefore as you read my take-away from the book, I encourage you to read the book as well to identify your own takeaways.

What are your thoughts about my takeaways? Have you read the book as well? I’d love to hear your thoughts in the comments section below.