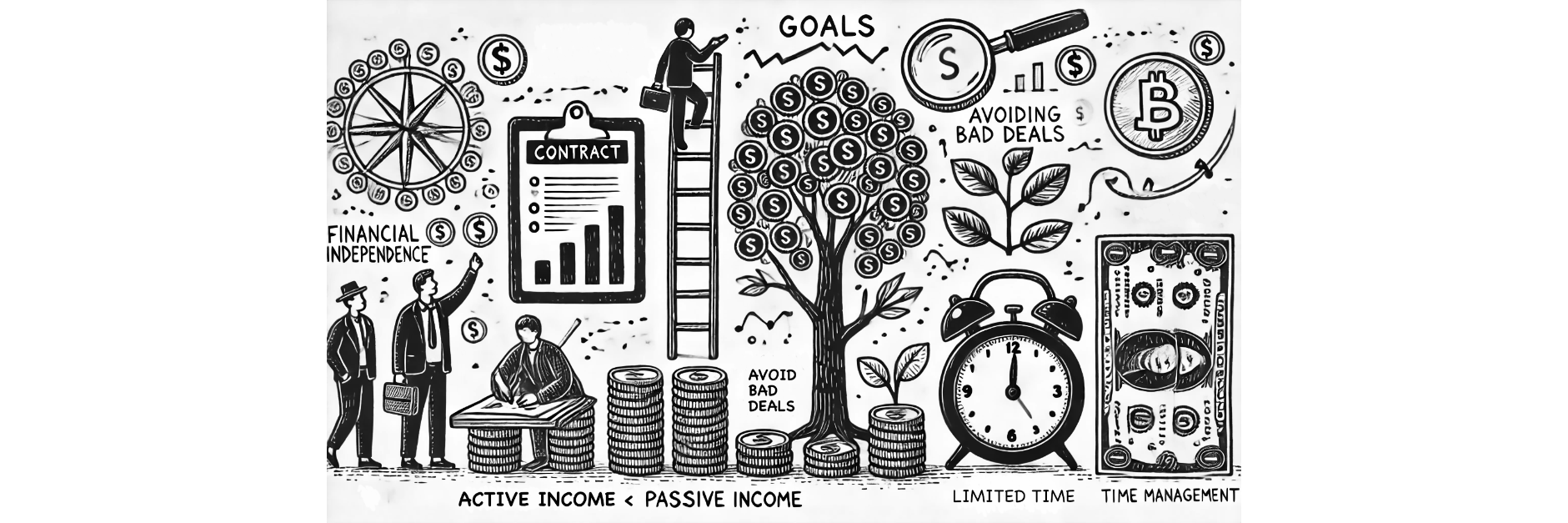

5 Money Lessons I Learnt From Playing the Wealth and Joy Financial Literacy Game

Life and money are deeply intertwined, much like the decisions we make in financial literacy games. Recently, I played the Wealth and Joy board game for the first time. Not only did I found the game fun, it also mirrored real-life challenges, offering profound insights into managing finances and achieving life goals.

Here are the life and money lessons I took away and how they may apply to your journey to financial freedom and early retirement.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

The Need to Balancing Love and Finances in Marriages

In the game, two players chose to get married after landing at the marriage space on the board. Their spouses had stable jobs with good incomes, but they spent equally as much, resulting in a significant increase in household expenses without improving any cash flow. One player even faced penalties for selecting a same-sex partner, reflecting real-world biases.

If financial independence is your goal, financial compatibility with a partner is crucial. While love isn’t always about money, it’s essential to recognise that marrying someone who doesn’t contribute positively to household cash flow could make achieving financial goals more difficult.

For couples planning for retirement, this means carefully budgeting and setting shared priorities to stay on track to move forward together.

Achieving Big Dreams Requires Big Risks

In the game, I set a bold goal to own a private island and required luck to land in a specific space that would result in venture capital payoff in order to achieve my goal. Unsurprisingly, I didn’t achieve my goal.

While I didn’t achieve it, I learned that time (both in game and life) is limited. Ambitious goals require proportional risks and consistent effort to yield the returns needed for success.

Whether it’s retiring early, pursuing a dream home, or traveling the world, achieving big goals means taking calculated risks. For those with limited time due to career or family responsibilities, leveraging automated financial tools or diversified investments can help align your actions with your aspirations.

The Power of Passive Income

The game offered two types of opportunities. On one hand, there are the affordable options, such as sidelines or finance opportunities, that required minimal investment but mainly increased active income. On the other are more expensive options, like real estate or enterprise opportunities, which required higher initial capital but generated sustainable passive income.

Many players (including myself) found it easier to pursue active income opportunities, but those who focused on passive income had a better chance of escaping the rat race.

Building passive income streams, such as rental property, REITs, or dividend-paying stocks, can create long-term financial stability. While active income is tied to your time and effort, passive income continues to grow even when you’re not working.

This is particularly important for those nearing retirement or managing busy careers who want to ensure financial security without overexerting themselves.

Recognising and Avoiding Bad Deals

During the game, one player convinced another to take a loan to finance a property deal, promising future benefits. However, the financier was left with debt and no passive income, while the original player gifted the property to someone else in exchange for debt relief. This resulted in both the original player and the player who received the gift getting out of the rat race while the financier remained stuck in the rat race for the rest of the game.

Not every opportunity is a good one. Whether in the game or in real life, it’s important to evaluate financial decisions objectively and walk away from bad deals. For those planning retirement or navigating busy careers, this means focusing on clear benefits and avoiding emotionally driven or poorly structured arrangements that could derail your financial goals.

Short-Term Relief vs. Long-Term Impact

In the game, a player with cash flow problems asked others to let him speed through his turns to get his next income payout. While this solved his short-term issue, it didn’t benefit the group and highlighted how unequal actions could widen the wealth gap.

This mirrors real-world scenarios like quiet quitting or prioritising work-life balance at the expense of income growth. While it’s crucial to address short-term financial and life challenges, maintaining long-term strategies for wealth creation is equally important. Those nearing retirement or considering overseas living should be mindful of balancing short-term needs with long-term stability.

Applying Game Lessons to Life

The Wealth and Joy board game is more than entertainment. It’s a reflection of real-world financial and life decisions. Here’s how you can apply these lessons to your own journey:

- Marriage and Finances: Evaluate how your partner’s financial habits affect your shared goals. For couples planning retirement, this could mean creating a joint budget and aligning on key priorities.

- Setting Big Goals: Time is limited, so aim high and take the necessary risks to achieve your aspirations. Whether it’s building an investment portfolio or saving for retirement, consistency matters.

- Focusing on Passive Income: Transition from active to passive income sources to secure your financial future, especially if you’re looking to reduce work hours or retire abroad.

- Avoiding Bad Deals: Learn to recognise and walk away from financial opportunities that don’t serve your long-term interests.

- Balancing Short and Long-Term Needs: While addressing immediate financial challenges is important, maintaining long-term strategies ensures lasting security and growth.

What’s Next?

This game helped me see life’s financial challenges from new perspectives. What about you? Are you making decisions today that will help you achieve your financial goals tomorrow?

Whether you’re planning for retirement, balancing a busy career, or considering relocating abroad, there are lessons here for everyone. Let’s continue the conversation by sharing your thoughts in the comments.