Understanding insurance: It’s all about risk management

Do you really understand why you need insurance?

I don’t want to say that all insurance agents are unscrupulous and money-minded, because I have a few friends who work as insurance agents and are really good at their job.

The sad reality is that insurers are dishing out very attractive commissions for insurance products that are designed to make you part with more money than what you have to. They make their products more complicated by integrating elements of investment to charge a higher premium and grow their corporate revenue.

For a insurance agent who’s basically an insurer’s sales person, it’s very hard to not focus on selling the more profitable products.

You have to look out for yourself because nobody is doing it for you.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

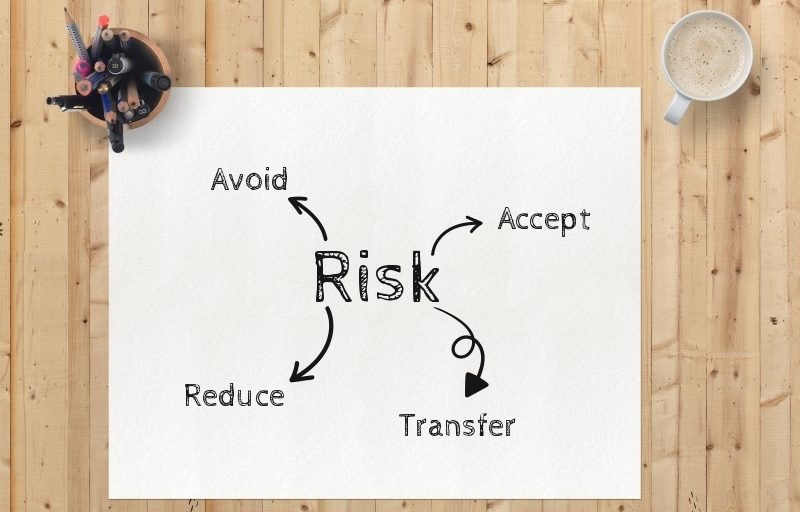

Insurance is all about risk management

Opposed to what many insurance agents are telling you, insurance is actually all about mitigating risk.

You just bought your home and did a nice renovation. Losing your home and belongings to fire or theft could mean losing everything. In order to mitigate that risk, you buy a home insurance to reimburse you for your losses.

That in my opinion, is what insurance is truly meant to do.

What you need to understand about risk

Start by determining the probability and impact of your risk.

TL;DR? Here’s a risk matrix to help you understand risk management in a nutshell.

Avoid risks that have high impact and high probability

If a risk has a high impact to your life and a high probability of occurring, the best way to eliminate this risk is to not participate in the particular activity or own the particular property.

The high impact could cost you everything you worked for (or your life) and the high probability of occurring means that insurers will charge you an arm and a leg just to protect you from the risk.

Reduce the probability of the risk occurring

Obviously we can’t avoid all forms of risks or we’ll never leave our home or cross the street. If the impact of the risk is not devastating, we can try to manage the risk by reducing the chance of it happening.

In most cases, reducing risk is just a matter of using common sense and doing things you know you should have done.

- Servicing your air conditioning to prevent water leakage

- Not drinking and driving to reduce the risk of getting into a car accident

- Not showing off your cash and jewelry in public to reduce the risk of getting robbed

If you can reduce the chance of a risk occurring, you may opt not to get any insurance to protect yourself against it.

Accept that there are some risks you have to take

There are some risks that have a low probability of occurring and low impact on your life should they occur. For these risks do you even need insurance coverage?

In some cases, the answer could be no.

Here’s an example.

You buy a standing fan from Courts for $39 and the cashier tries to sell you their in-house warranty that offers a longer and more comprehensive coverage for $10 (this is a fictitious amount). Personally, I would be willing to accept the risk of the fan breaking down and will either pay out of my own pocket for the repairs or purchase a new standing fan when that happens.

The amount of risks you are willing to accept depends largely on your risk appetite.

For me, I don’t always buy travel insurance for short holiday trips because I am willing to accept the risks involved. You may not want to accept these risks.

Transfer some risks to other parties

For risks that do not have a high probability of occurring but can make a large impact to your life when that happens, you would want to consider transferring these risks from you to another party.

Buying insurance is the most common method of risk transfer.

Insurance allows you to pay a predetermined fee (premium) and in return, the insurer takes over the risks from you. Should the risk occur, the insurer will absorb the losses that you would otherwise have to pay out of pocket.

Insurance makes the most sense when the impact of the risk is large but the cost to transfer the risk is low in perspective.

Here are a few examples:

- Transferring the risk of having to rebuild your $500,000 home after a fire to an insurer by buying a home insurance for $200 per year

- Buying a term life insurance to transfer the risk of leaving your family with debts when you pass away

- Purchasing a health insurance to transfer the risk of incurring hefty hospitalization fees, should you be struck with a major illness

Making your insurance purchasing decisions after understanding risks

You now understand what risk management is all about.

It’s time for you to decide what are the personal risks that you are undertaking today and how you should manage them.

If the insurance product that you are considering to purchase does not transfer away an adequate amount of personal risk for a low cost, then you don’t really need them.

If your insurance agent is talking to you about project returns and profits for purchasing an insurance product, instead of how the product can protect you from certain personal risks, walk away.

Do you agree with my view in this article? I’d love to hear your thoughts in the comment section below.

The risk matrix is insurance 101 that probably makes up 1% of a new sales adviser’s training.

Problem is that a sales adviser’s KPI also largely depends on hitting minimum monthly quotas of the more profitable products.

So even if he/she doesn’t mind getting less commissions & wants to focus on useful insurance, wouldn’t last long with the company.

I absolutely agree with what you’re saying here. If my income is based on what I sell, I’d definitely strive to sell the product that gets me the highest percentage of income.

That’s why as individuals, we should learn to decide for ourselves whether we really need the particular insurance product.