My Approach to Building a Client-First Financial Advisory Practice

Over the 8 months in my career break, I am slowly discovering a “superpower” that I didn’t realise that I have. That’s the power to have meaningful money conversations with people, even with strangers. At the same time, I’m cognizant of the “limiter” that is preventing me from fully utilising my my “superpower” and that’s the lack of a license to give personalised financial advice.

To remove the “limiter” to my “superpower”, I decided to join the financial advisory business.

”Huh? Why you wanna join? I thought you stood on other side lol.”

That was what Dawn from SG Budget Babe said to me.

Entering the financial advisory business is a significant step, one that requires careful thought about not only how to succeed but also how to do so ethically and sustainably according to my values. The more I consider the intricacies of this field, the more I realise that building a trustworthy, client-centered practice is both a challenge and an opportunity.

In this article, I’ll share my thoughts on key considerations, the commission structure dilemma, and my plans for aligning my practice with my values.

Every week, I’ll be sharing practical tips and invaluable knowledge to guide you on your path to financial independence.

Navigating the Lucrative Commission Structure with Transparency and Ethics

It’d be a lie if i say that I’m don’t want to make money when I join the financial advisory business. But one of my main concerns about the financial advisory business has always been the traditional commission-based compensation model. While commissions are a standard in the industry, they can create conflicts of interest that might not align with my desire to provide unbiased, client-first advice.

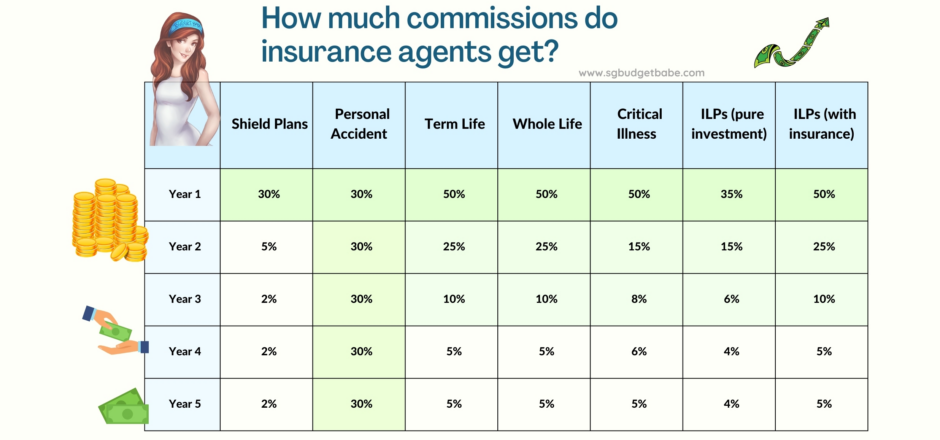

If we look at the commission table from Dawn’s article that shows the amount of commissions that insurance agents get when they sell a policy, we can see that the types of insurance products that reward insurance agents the most, are Personal Accident, followed by Term Life, Whole Life, followed by ILPs. But if you think of it from absolute terms, the commission from Term Life insurance products are actually not that much.

NGL, the commission structure for insurance products are very attractive. They are so attractive that after reading Dawn’s article, Christopher Ng from Growing your tree of prosperity told me that the smarter move would be to sell ILP products for the first few years before changing to selling insurance products that is right for the customers and align with my values..

What I Dislike about the Commission Structure

The commission model typically offers high upfront payments to advisors when a policy is sold, followed by smaller renewal commissions over the next few years. This structure might inadvertently encourage a continued focus on closing sales rather than providing ongoing, quality service throughout the client’s lifecycle.

I find it uncomfortable that advisors are paid commissions for 6 years, yet are expected to serve the client over the lifetime of the policy. This front-loaded compensation can sometimes lead to scenarios where the advisor has little to no financial incentive to maintain a high level of unbiased service after the initial sale and every policy review is inevitably another opportunity to sell another insurance product.

The Negative Impact on Client Returns

Another issue is that front-loading commissions can negatively impact clients’ short-term returns. High initial costs can erode the early value of investments, which may not be in the client’s best interest, especially if they have a long-term investment horizon.

The high commission is one of the factors that lengthens the years needed for a client’s policy to break even. This realisation is pushing me to think about alternative ways to structure my compensation that not only rewards me for my work, but also aligns better with my clients’ financial goals.

Exploring Alternative Compensation Models

To address these concerns and align my financial advisory work with my values, I am considering incorporating alternative compensation models that reduce reliance on upfront commissions and promote long-term client relationships.

Fee-Only Advisory Services

A fee-only model could be a way forward. Instead of earning commissions from product sales, I could charge a flat fee for my advisory services. This fee could be based on the complexity of the client’s financial situation or the time required to develop and maintain their financial plan. This model ensures that my advice is unbiased and focused entirely on the client’s best interests.

However, regular consumers are not willing to pay for financial advice. This is evident from the closure of MoneyOwl. Unless I have a better way of executing this, it is unlikely that I would succeed with this form of monetisation.

Retainer Fees for Ongoing Service

Retainer fees are another option I’m considering. Clients could pay a regular, ongoing fee (monthly, quarterly, or annually) for continued access to my advice and services. This would provide a stable income stream and reinforce the idea of a long-term relationship, where I am available to help clients navigate changes in their financial situation.

This is an option I intend to pursue right now, because this allows me to focus on holistically research and plan for my clients across different angles beyond just the products offered by my financial advisory agency. This also takes away the incentive to focus on selling more products to my clients for the sake of earning commissions.

Hybrid Model: Combining Fees and Commissions

Alternatively, I could adopt a hybrid model, which combines fee-based services with commission-based earnings. For example, charging a fee for developing a comprehensive financial training program and then earning a commission if the client decides to implement my recommendations through me.

This hybrid approach would allow for flexibility while providing clients with transparency about how I am compensated. I consider this an idealistic option because it will be difficult to implement and convince prospects to pay for the training program. But it will allow me to achieve my personal goal of improving financial literacy of Singaporeans in the long run.

There Is a Finite Number of Clients That I Can Take On

When I was researching about the financial advisory business, a crucial takeaway is the importance of finding a “sweet spot” in the number of clients I serve. Quality over quantity is essential, not just for my clients’ benefit but for my peace of mind and work-life balance.

Kyith from Investment Moats wrote in his article that financial advisors will eventually reach a cut-off point where they stop taking on new clients.

Many successful advisors choose to limit their client base to provide more personalised and attentive service. For example, some advisors manage between 30 to 50 clients, which allows them to focus on each client’s unique needs without feeling overwhelmed. This client cap helps maintain high service standards, ensures I can provide each client with the attention they deserve, and aligns with my goal of building long-term relationships.

I did the math on how many hours I think I will be spending with each client in the table below.

| Description | Hours |

|---|---|

| Quarterly portfolio rebalancing | 2 |

| Bi-yearly client follow-ups | 6 |

| Adhoc conversations | 10 |

| Total hours per client | 18 |

| Number of clients | 100 |

| Yearly hours spent | 1800 |

| Yearly days spent | 225 |

From what we can see, I will probably land with a reasonable cap of around 100 clients with a decent amount of time for myself to rest and relax. For a start, I will give myself a year to close 10 clients. As I gain experience and refine my service model, I can adjust this number to maintain a balance between client satisfaction and my workload.

Conclusion on Building a Client-Centric, Ethical Financial Advisory Practice

At the time of publishing this article, I am still self-studying to take my first Capital Markets and Financial Advisory Services (CMFAS) Examination paper. I am also working on my Business Model Canvas and researching with potential clients to map out a unique value proposition that would help me stand out from other financial advisors.

Joining the financial advisory business comes with its set of challenges, particularly around commission structures and potential conflicts of interest. However, by carefully considering how I structure my business, focusing on transparency, and committing to long-term client relationships, I believe I can build a practice that is both successful and aligned with my values. Some of my friends think that I am overly ambitious, considering how the financial advisory business functions today.

By prioritising the needs of my clients, exploring alternative compensation models, and maintaining high ethical standards, I hope to create a trusted, client-focused financial advisory service. This approach not only benefits my clients by providing them with honest, unbiased advice but also helps me build a sustainable and fulfilling career in financial advisory.