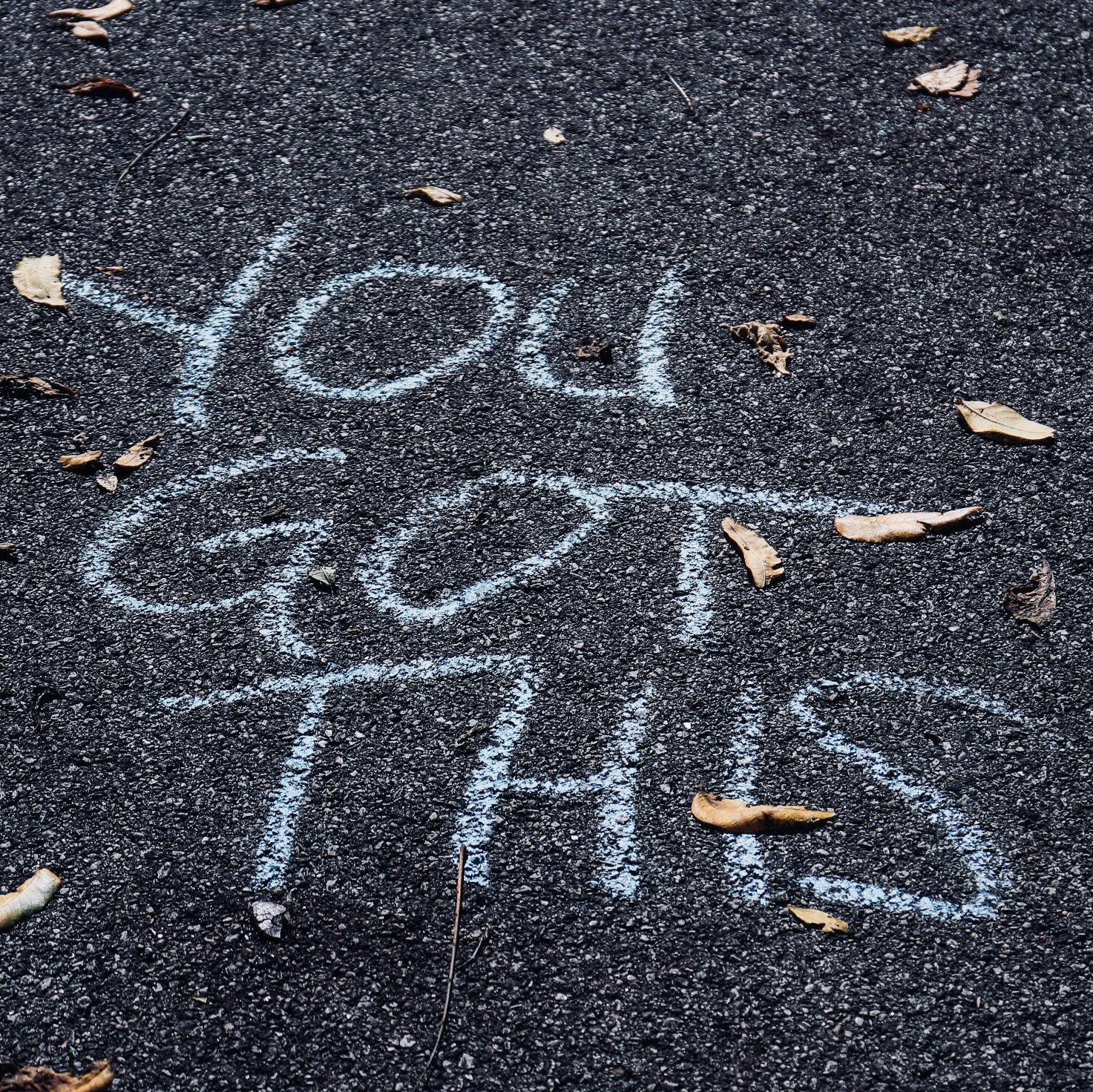

You Can Retire Earlier Than You Think

Discover the simple and easy way to achieve financial independence

My Financial Planning Philosophy

Easy and Simple

Simplify the complexities of financial planning by breaking them into manageable chunks and focus on the gaps. I choose to separate insurance from investment so that I can optimise my insurance expenses for protection based on my needs while maximising my investment budget for a diversified investment portfolio.

Comprehensive and Robust

My financial plan is created with the possibility of living to the age of 100 in mind with milestones that I want to achieve along the way. A review on my financial plan at the end of each year to assess my performances. I keep my financial plan robust and fluid to pivot with my circumstances, government policy changes, and investment opportunities

Disciplined and Automated

Staying consistent on a planned ‘Buy Term and Invest the Rest’ financial journey over many years is very difficult with the challenges that life throws at us. That’s why I created a systematic process that automates most of my saving and investment processes. That takes most of the manual tasks out of my hands so that I can focus on enjoying the present, with my future all taken care of.