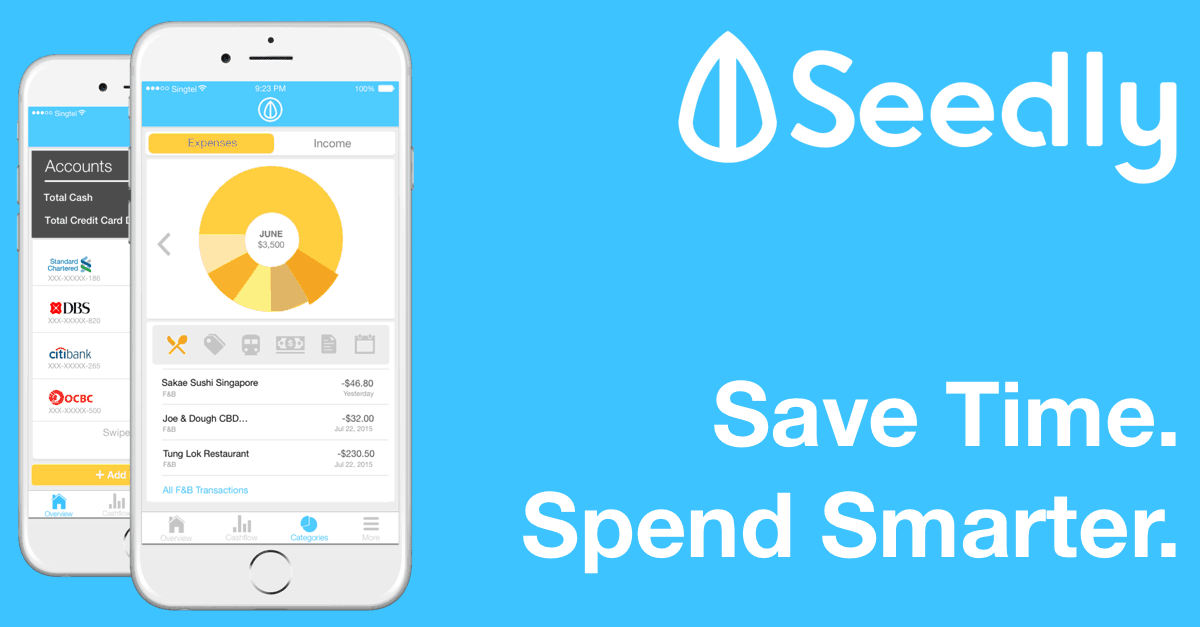

Automate your expense tracking with Seedly

I would like to consider myself a Millennial. An old one.

I love automation and I want to automate most of my everyday tasks as much as possible. That includes expense tracking. My current process involves manually logging my spendings as they happen. Then, I update my Google Spreadsheet with my total expenses at the end of the month.

As I browse the MrMoneyMustache forum, I see how fellow MMMs in America use SaaS online services such as Mint and Personal Capital to track their expenses. It’s the perfect solution because they can connect to their bank accounts and extract their transactional data. All that data gets categorised into the different expenses and income categories and even displays the information in meaningful charts.

Sadly, Personal Capital and Mint does not work in Singapore so for the past 2 years, I’ve been tracking my expenses manually with apps and Google Spreadsheets.

Last month, I discovered Seedly, a Singapore-based fintech startup founded in early 2016 that aims to acts as a personal finance assistant to give you your overview balances, monthly cashflow and categorizes of all your expenses by syncing up to the 5 major banks in Singapore.

This could be the solution to automate my expense tracking process!

Well, sort of.

In its infancy, the Seedly app does what it promises but is rather basic with only 10 categories for expenses (no, you can’t add any manually). I’d really love to have a few more categories for other expenses.

That said, it’s really awesome that I can sync all the transactions in my bank accounts using the app without keying in the expenses each time I use my credit card.

Seedly is not without its disadvantages though. It doesn’t allow me to track my cash expenses so I’m still manually logging my expenses in another expense tracking app every time I’m paying for something with cash. I hope the Seedly team is doing something about this.

Update: The latest Seedly app update allows manually logging of expenses so I’ve started using Seedly as my expense tracker for cash expenses now.

Here are 3 reasons why you should download Seedly.

- The app is made in Singapore. Support local startups!

- There’s really no other app like Seedly in Singapore.

- Expense tracking is much easier when you automate most of the work.

For the next 3 months, I’m going to try using Seedly to record all my banking transactions and my current expense tracking app for cash transactions and share about my experience in another article.

Give Seedly a try and let me know what you think in the comments below.

There’s an adv in keying in manually. It gives one a lot more thought and less prone to spending carelessly. Also I would be a little worried about the security behind such links. Opening another door for hackers to go in? Haha

Btw, i’m using ynab for a few years already. You might want to try that.

Thanks for sharing!

I’ve tried using ynab once and setting it up was very tough for me and I could never get the numbers to balance.

I agree with your comment about security and that will be something Seedly needs to prove to its users.

you can use this app “clara”, i find it ez to use too

Thanks for sharing, Kelvin. 🙂

Hi Mickey!

My name is Jackie and I work for Personal Capital. I have a quick question for you — if you could email me at jacqueline.quasney@mail.personalcapital.com I would really appreciate it!